Shares of Netflix soared to an all-time high after the streaming giant’s big bet on sports helped add a record 18.9 million subscribers in the holiday quarter, ballooning its already sizeable advantage over other players.

Shares of Netflix soared to an all-time high after the streaming giant’s big bet on sports helped add a record 18.9 million subscribers in the holiday quarter, ballooning its already sizeable advantage over other players.

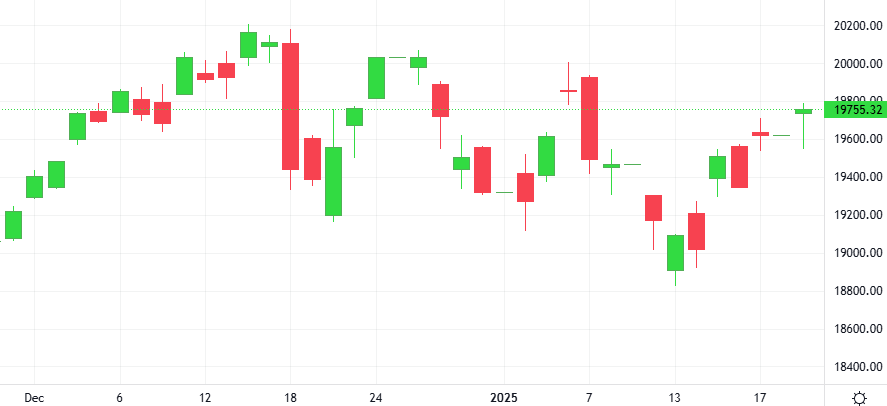

Wall Street’s main indexes rose, with the blue-chip Dow at a more than one-month high, as investors assessed President Donald Trump’s executive orders after taking office and awaited his first move on trade policy.

Dogecoin jumped in double-digit percentage in 15 minutes following the announcement of the official website launch of the US Government Efficiency Department, breaking its short-term downtrend.

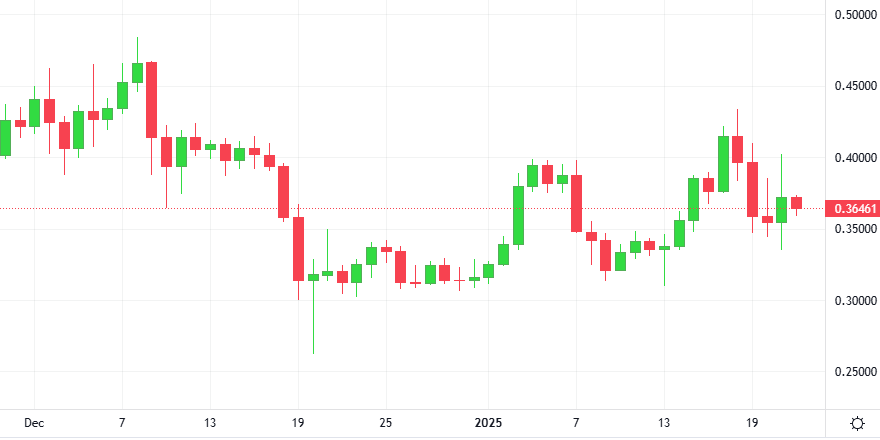

Gold prices jumped to a over two-month peak, supported by a weaker dollar and as markets flocked to the safe-haven asset as uncertainty surrounding U.S. President Donald Trump’s potential tariffs continued to loom.

The Gold-Dollar pair exploded 1.2% in the last session. The RSI is giving a positive signal.

Support: 2672.8 | Resistance: 2802.1

The dollar tumbled broadly after an official for incoming U.S. administration said President-elect Donald Trump would not impose new trade tariffs on his first day in office, alleviating some fears of an immediate blitz.

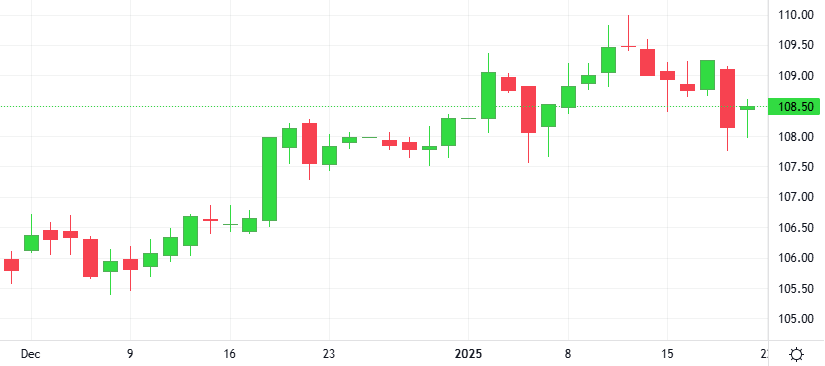

The price of Bitcoin surged by more than 6% in minutes to a new high ahead of Donald Trump’s inauguration as president of the United States. Bitcoin briefly surged above $109,000, breaking its previous all-time high above $108,000 recorded on December 17, 2024.

The Bitcoin-Dollar pair skyrocketed 2.1% in the last session. The Stochastic indicator is giving a positive signal.

Support: 89162 | Resistance: 118490