Oil prices settled lower after U.S. President Donald Trump was sworn in for a second time, and said he would immediately declare a national energy emergency, promising to fill up strategic reserves and export American energy all over the world.

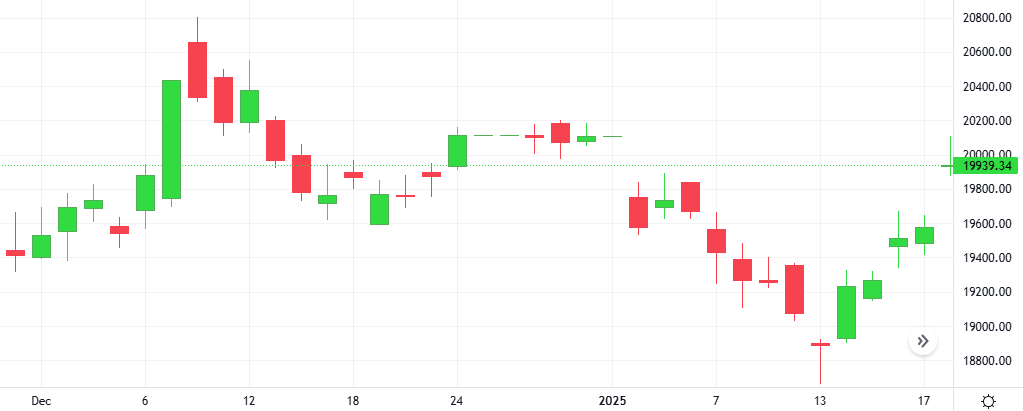

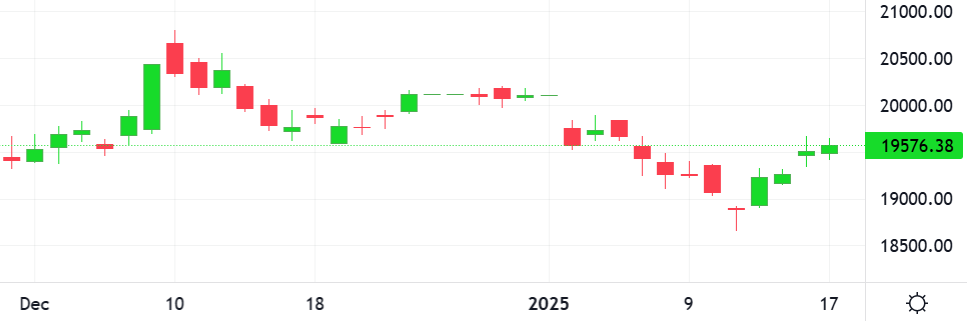

The Oil-Dollar pair fell 1.7% following a 2.3% intra-session dip. The Williams indicator is giving a negative signal.

Support: 73.47 | Resistance: 79.439