The U.S. dollar advanced to one-year high against major currencies powered by so-called Trump trades and after U.S. inflation for October came in as expected, suggesting the Federal Reserve will continue lowering interest rates.

The U.S. dollar advanced to one-year high against major currencies powered by so-called Trump trades and after U.S. inflation for October came in as expected, suggesting the Federal Reserve will continue lowering interest rates.

Gold prices extended losses for the fourth straight session, weighed down by a stronger dollar and elevated bond yields on news that October U.S. consumer prices increased as expected.

The Gold fell 0.6% against the Dollar in the last trading session. According to the Stochastic-RSI, we are in an oversold market.

Support: 2525.7 | Resistance: 2648.4

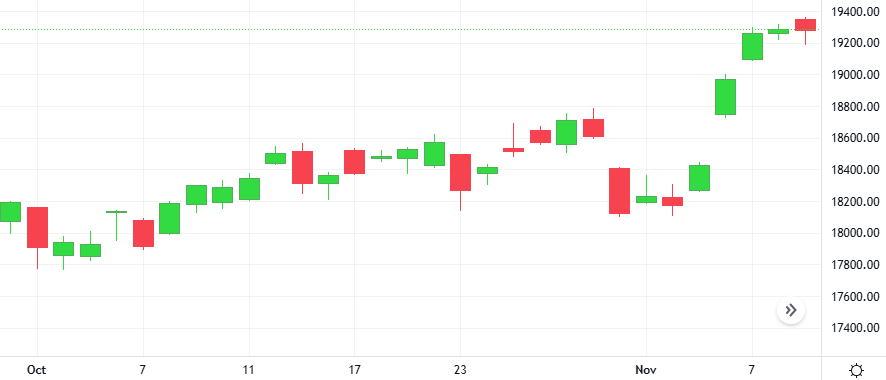

Wall Street’s main indexes fell as investors booked profits following post-election gains over the past few days, while focus moved to key inflation data later in the week. Some of the stocks expected to perform well under Donald Trump’s presidency gave back gains.

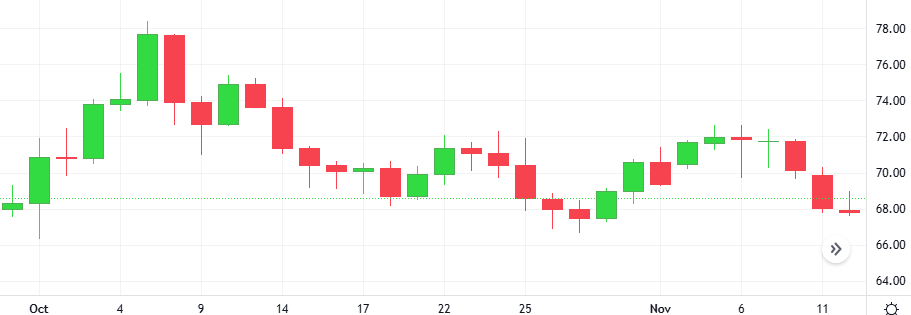

Oil prices held near a two-week low after dropping about 5% over the past two sessions as investors absorbed OPEC’s latest downward revision for demand growth, a stronger U.S. dollar and disappointment over China’s latest stimulus plan.

The Oil-Dollar pair rose 0.2% in the last session after gaining as much as 1.3% during the session. The CCI is giving a negative signal.

Support: 66.17 | Resistance: 70.129

The U.S. dollar rose to a near five-month high against major peers, buoyed by expectations of inflationary import tariffs from Republican President-elect Donald Trump, while bitcoin pared gains from a record rally.

Wall Street’s indexes were near record highs, ahead of an upcoming batch of economic data that could influence the Federal Reserve’s pace of interest rate cuts. Several stocks added to gains they have notched since Donald Trump won the election, as traders expect them to benefit from his return to the White House.