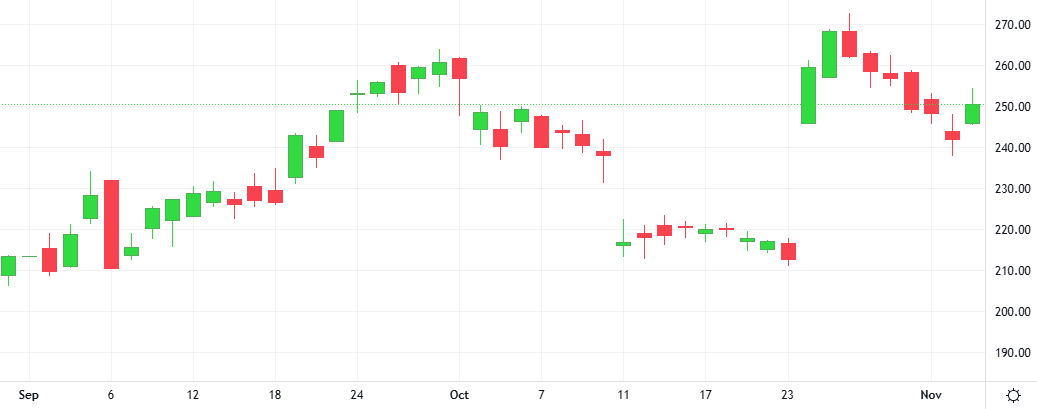

Tesla Stock Daily Chart

In April, Tesla’s stock dropped when news surfaced that it had scrapped plans for a $25,000 EV. Elon Musk quickly responded, calling the report “a lie”, and shares regained some ground. However, Musk now suggests that a low-cost EV is “pointless” without full autonomy.