Ether investment funds have seen record net inflows of $2.2 billion in 2024, finally surpassing the cryptocurrency’s 2021 net inflow record of roughly $2 billion, according to CoinShares.

Ether investment funds have seen record net inflows of $2.2 billion in 2024, finally surpassing the cryptocurrency’s 2021 net inflow record of roughly $2 billion, according to CoinShares.

British house prices rose at their fastest annual pace in two years in November, adding to signs of resilience in the property market despite high borrowing costs. Prices rose by 3.7% in November compared with the same month last year.

Bitcoin recorded a 129% year-to-date gain, primarily driven by the outcome of the 2024 United States Presidential election and the April 2024 halving event. Bitcoin also experienced a 37% gain in November 2024.

The Bitcoin rose 0.8% against the Dollar in the last trading session. According to the Williams indicator, we are in an overbought market.

Support: 94392 | Resistance: 99738

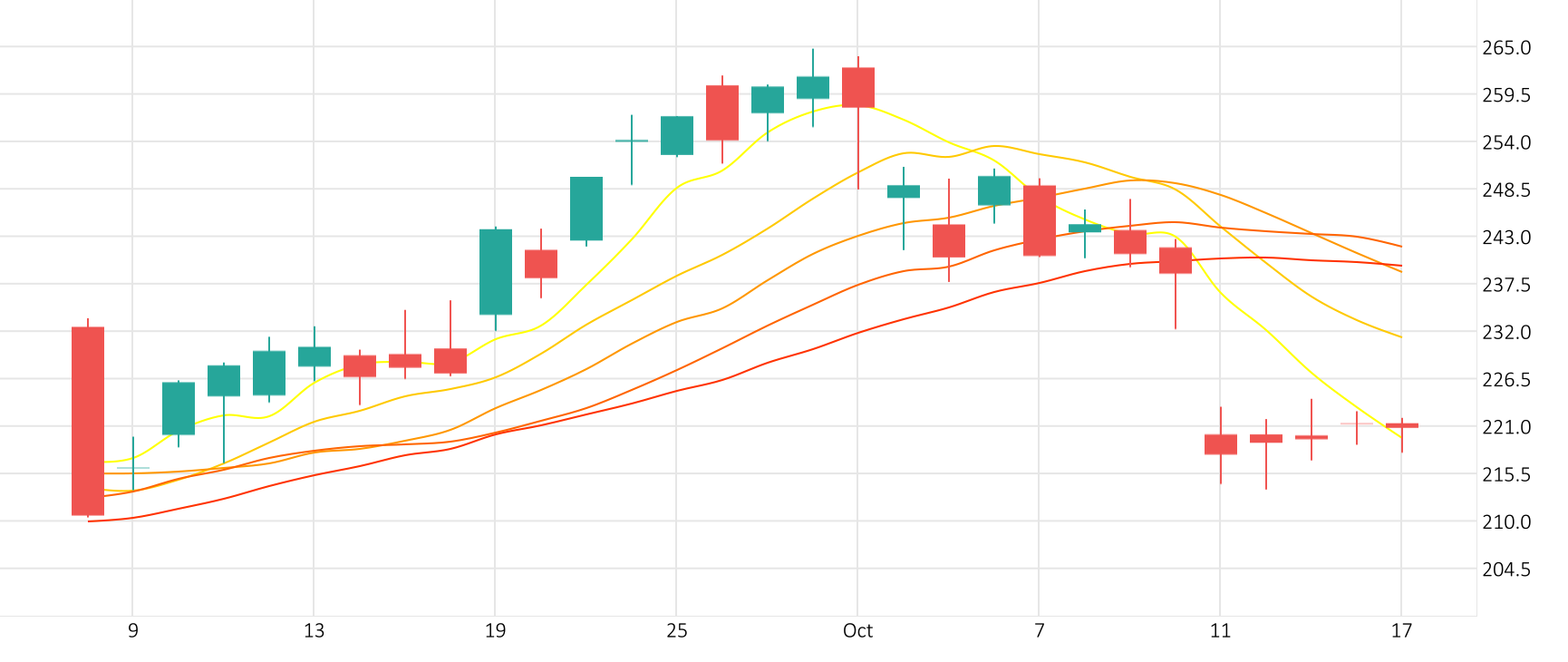

The last session saw Tesla shares gain 2.6%. The MACD is giving a negative signal.

Tesla’s stock rose 2.6% in the last session.

The MACD is currently in the negative zone.

Support: 327.25 | Resistance: 359.65

The coming week will give investors a fresh view into the health of the U.S. economy with the release of a closely watched employment report that could help determine the trajectory of interest rates in the months ahead. Stocks are heading into December with the benchmark S&P 500 near record highs following an over 25% year-to-date gain.

The S&P 500 and Dow Jones Industrial Average notched record closing highs in a shortened Black Friday session, lifted by technology stocks such as Nvidia, while retail was in focus as the holiday shopping season kicked off.

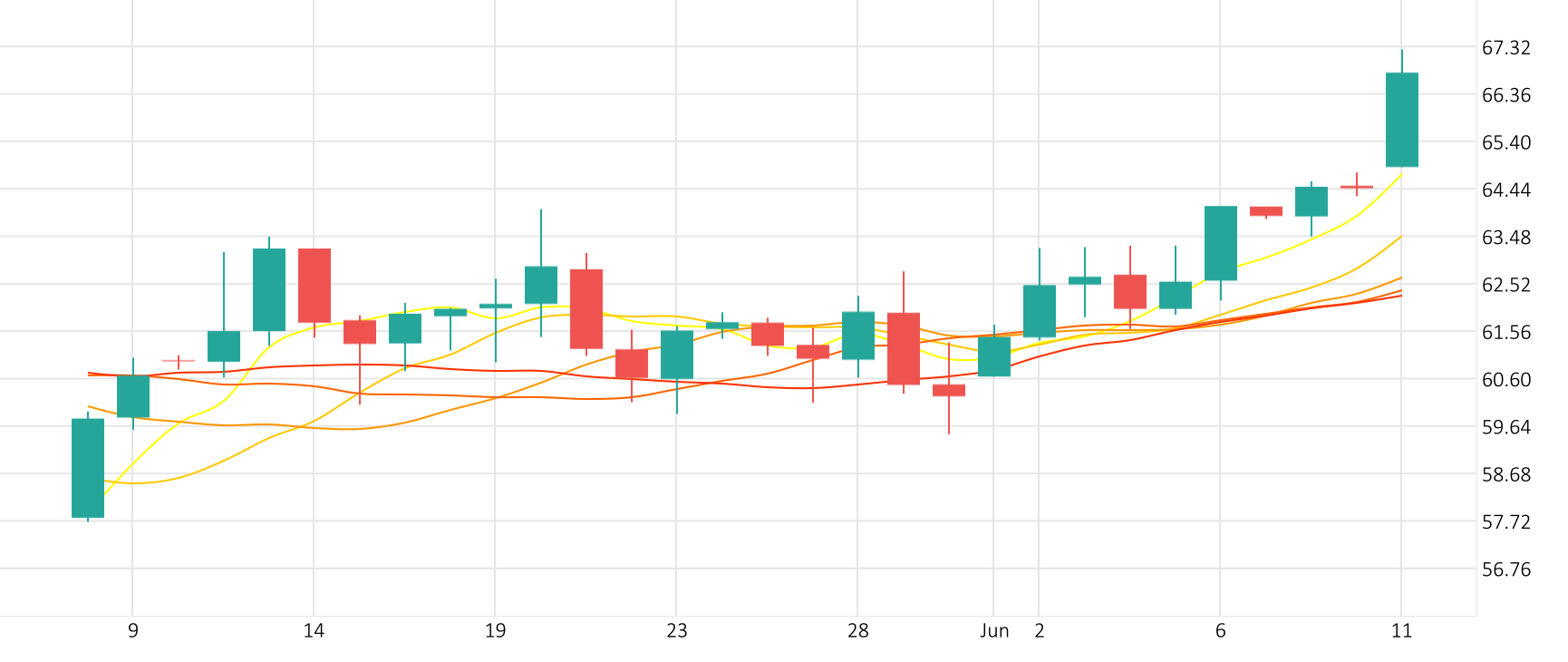

Oil prices ticked up after Israel and Lebanese armed group Hezbollah traded accusations that their ceasefire had been violated, and as Israeli tanks fired on south Lebanon. OPEC+ also delayed by a few days a meeting likely to extend production cuts.

The last session saw the Oil gain 0.3% against the Dollar. The Stochastic indicator is giving a negative signal.

Support: 67.269 | Resistance: 70.33