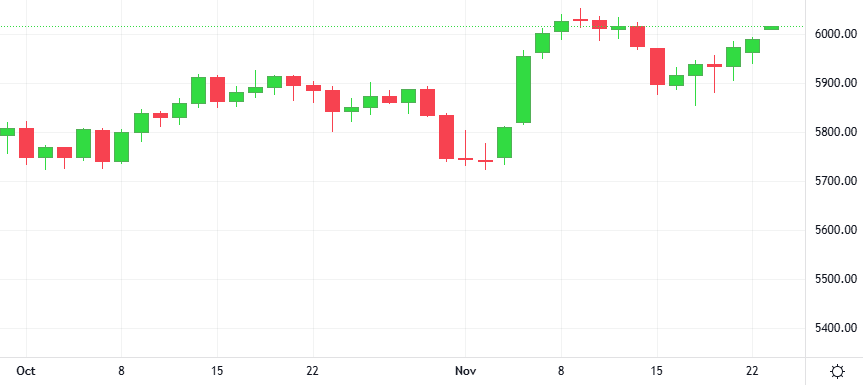

| Global stocks registered a strong weekly gain while U.S. The health of the U.S. consumer and the retail sector will be in focus in the coming week, as Black Friday kicked off a holiday shopping season that could shed light on how buyers are grappling with higher prices. The benchmark S&P 500 rose 1.7% in the past week and approached all-time highs. |