The Magic of Forex Trading Scalping

By Content-mgr - on March 21, 2016Forex trading scalping is seen by many as a boring concept for trading currencies. But this is not so. Trading zones in the forex market provide the answer.

Forex Trading Scalping is All about Avoiding Active Trading Hours

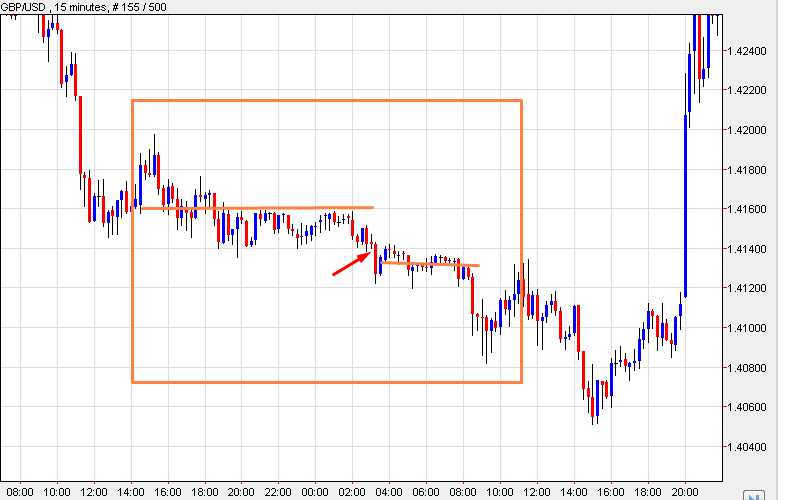

Forex trading scalping is not boring at all. It could be risky, very risky in fact if one trades during the wrong hours. Scalpers are directionless traders who simply want to see market price move up and down for many minutes. The risk is that if market price breaks out in either direction, then 50% of their attempted trades will be losers. And if one trades mechanically on such a breakout, the losing trades will be much bigger than the profitable ones. Scalpers don’t have large profitable trades, even a 6 pip profitable trade is something they will accept. Forex trading scalping is really interesting when one chooses selectively how and when they will trade. Forex trading through scalping is all about avoiding extremely volatile trading hours. Maximum volatility occurs when economic announcements are made. And these economic announcements are made during the active hours in the countries in question. GBPUSD for example, is currency pair which relates to two countries, Britain and USA. Hence all economic announcements are made during the active trading hours in these two countries. If one wants to scalp GBPUSD, they will have to look for the best trading hours within the Asian trading session. That’s when this particular currency pair will be safest to scalp. The currency pair will still move up and down, throughout the Asian trading session. But a large part of this period will be kind of mean-reverting. Where price will be reverting back to a baseline, from both directions. So the scalper simply has to buy dips and sell rallies below and above the perceived baseline respectively. Online trading has evolved in the last 15 years, this hasn’t necessarily made markets less risky to trade. Selective trading however is possible, even in the case of scalping. There is a lot preparation involved, and some days may not even qualify for scalping. But those that do, offer amazing profitability.

Forex Trading Scalping and Day Selection

Forex trading scalping mainly about selecting the right currency pair and corresponding trading time zone. But one can enhance scalping even more by eliminating few days in the trading month. Where market price still breaks out, even in the quiet trading time zone. Scalpers always tend to have a series of many profitable trades, for as long as a straight week, and then a nasty breakout day. On that nasty breakout day they usually give back almost all of the profits made in that week. That’s why trading time zone selection is not enough, unless one trades very carefully and can sense breakouts in the making. Forex scalpers do a lot of preparation on selecting the most suitable days for scalping, the actual trading is much easier to do, since it’s essentially directionless. As far as profitability goes, good scalpers typically make as much as $300 per such good day, even on small accounts, with less than $3,000 available. Good scalpers don’t chase losses, if the scalping session begins with losses and larger than expected price movements, they will quit for that day. Scalping doesn’t work with tight stops, they actually use 50pip or larger stop size. While profits may only be as little as 6 pips and as large as 30 pips on the most frequent trades.

Forex scalping is one of the best ways to experience trading for the first time, as it is about trading the less obvious patterns on the charts. Volatility has to be avoided, as well as surprise breakouts, this is where all the tasks are really hidden. So what is forex scalping in a nutshell? It’s a way to trade probability in the market, in a well defined, counter intuitive way. This is because large stops have to be used, and the objective is to only make few pips in every trade. But scalping can do so much more, for example it is possible to take a trading account that has been blown from $30,000 down to $5,000. Through other strategies, and to make a full recovery back to $30,000 through forex scalping, amazing, but it is very possible! Scalping is all about day selection, and risk control on any trades gone wrong. Beyond that, it can offer $300 profit, on every such day. It is therefore a trading method which many traders could have looked into, instead of just rushing to trade the obvious directional moves on the daily chart. Scalping is all about probability assessment, and this boils down to volatility-causing events, and the risk events (or absence of), during the next trading day.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification