How to Learn Online CFD Analysis

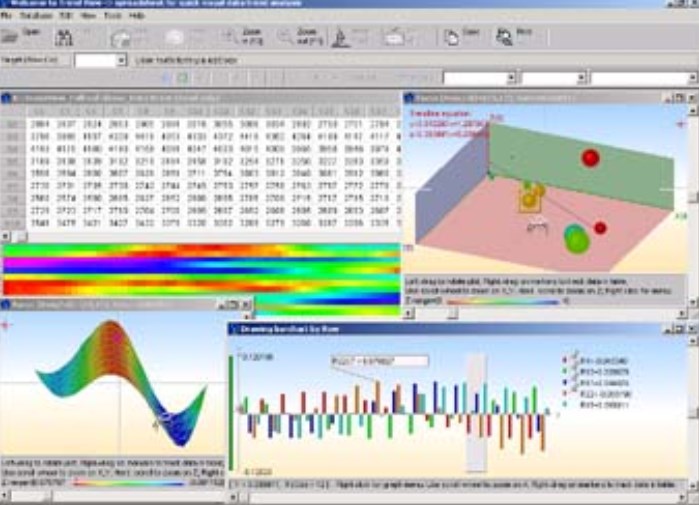

By Content-mgr - on June 9, 2016Online CFD trading helps traders of all kinds come up with new ideas all the time. This is because CFDs themselves are inherently innovative products, which broke the dogma of the trading world. In previous decades, investors knew only about stock trading, stock trading on margin and later about futures. The forex market was at a very primitive stage, where only investment bankers had access, and even fewer could figure out. And while the market risk is always there, evolution has at least made it possible for wise people to become top traders. Higher education is not essential, understanding of economics is not essential either. Moreover there is no universal truth in economic theory, and no one single economic model. It is possible for the average person, who is well motivated, to figure out real trading strategies and methods for these markets. By including CFDs in a trading strategy, the trader is now able to hedge risk in ways that are almost impossible to verbally describe, but are possible to describe through spreadsheet analysis and basic algebra. Online CFD trading allows to put these ideas to the test, and if successful, the trader stands to literally make millions over few months or years! This is because opportunity always exists in some places, but either risk or too much obscurity prevent the individual from exploiting that opportunity. And it gets complicated, because as one attempts to measure that risk and hedge against it, a minor oversight or miscalculation can mess up the entire formula, and yield the wrong number. The truth is that many events in the financial markets today carry risk, which can be almost completely mitigated through the right hedging strategy. And that hedging strategy can be implemented through CFDs trading. Online CFD brokers offer more than enough in terms of service and trading tools, that a trader will ever need in actual trading. The other part of the work involves simulation, modeling of risk in a spreadsheet, and a good imagination, which many young traders seem to have.

Online CFD Analysis for Hedging Trades

Online CFD trading for hedging purposes requires analysis on volatility and other metrics. But volatility is the number one field of research. CFDs themselves are linear and will do the job of hedging risk, easy to figure out and to implement. You simply trade from A to B, X number of points, and a CFD contract will provide the insurance needed. But together with market volatility, traders can learn when to execute that hedging trade, and at what trade size. Traders can start working on these two variables alone, volatility and trade size. And various attractive ideas will reveal themselves. Volatility is always a measure of market risk, but it works differently from market to market. So that volatility of the stock market goes up as stocks fall. But volatility of oil stocks goes down as crude oil falls. It’s because volatility measures fear, and fear hints that stocks risk going down on any day. And crude oil risks going to $200 a barrel during almost any week or month. Volatility creates asymmetries, ie stocks tend to fall much faster than they rise. As fear is always more pressing than greed. Using the right analysis approach, a good CFD trading software, and by being motivated, traders can excel in today’s markets. The opportunities will always exist, apparent risk and difference of opinion, as well as overall obscurity will always prevent the market from exploiting these opportunities. Trading online made easy through the use of these concepts and CFDs, is possible for those who are already even partially successful. It is certainly not easy for negative thinkers and people lacking original ideas. But many retail traders are original thinkers by their nature.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification