The Mexican Peso: Continued Strength and Lucrative Trading Prospects

By X-blogger - on August 1, 2023The Mexican peso is one of the best-performing currencies in recent years, it has appreciated more than 10% against the dollar, euro since the beginning of the year.

Introduction:

The Mexican Peso (MXN), the official currency of Mexico, has gained substantial attention from traders owing to its remarkable appreciation since April 2020. In this blog, we will explore the performance of the Mexican Peso, analyze the factors shaping its value, and uncover the reasons behind its allure for traders seeking lucrative opportunities in the forex market.

Performance of the Mexican Peso:

The Mexican Peso has exhibited resilience and strength in the face of economic challenges, showcasing impressive performance against other major currencies. Since reaching a low point in April 2020, the Peso has surged more than 35%, attracting traders’ interest and positioning itself as a prominent player in the financial markets.

Factors Influencing the Mexican Peso:

The robust performance of the Mexican Peso can be attributed to several key factors:

Strong Economic Recovery: Mexico’s economy has been witnessing a robust recovery from the pandemic-induced slowdown. As the nation’s economy gains momentum, investors are increasingly drawn to the potential for higher returns, thus driving up demand for the Mexican Peso.

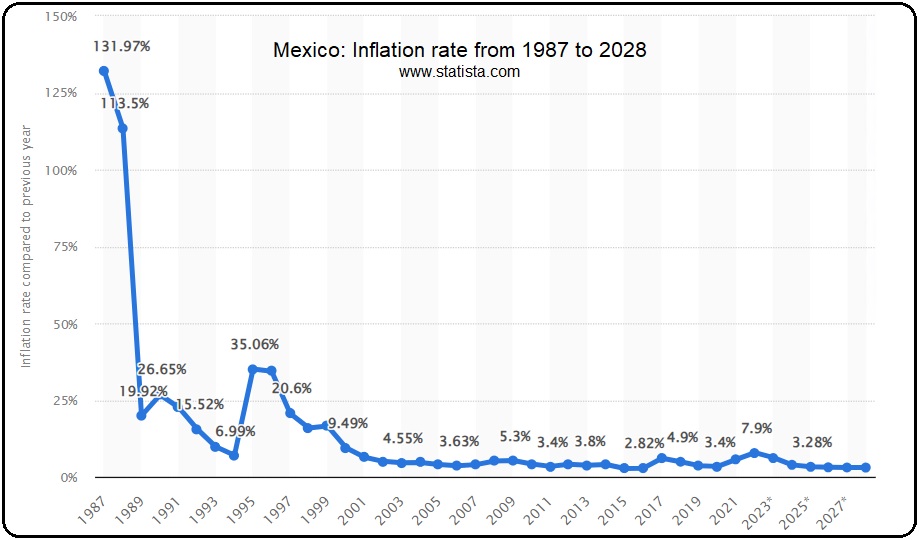

Slowing Inflation: Mexico’s inflation rate has been on a downward trajectory, creating a conducive environment for the country’s central bank to implement monetary policies that support the stability of the Peso. Lower inflation contributes to a more favorable investment climate.

According to economists in the most recent Citibanamex survey published last week, inflation at the end of 2023 is expected to be 4.66%, down from a forecast of 4.99% in June. The core forecast estimates have also inched down to 5.17% from 5.30%. Mexico’s inflation has continued its gradual slowdown in early July, aligning with forecasts, aided by double-digit interest rates and a robust peso.

Improved Investor Sentiment: Emerging market currencies, including the Mexican Peso, have gained traction among investors due to improved sentiment. As global investors seek higher yields and diversification, the Mexican currency emerges as an attractive option.

Tesla and other companies plan to open factories in Mexico, taking advantage of the country’s low labor costs and strategic location, have bolstered investor optimism. The opening of these factories could have several positive effects on the Mexican economy, including job creation, increased exports, and improved business climate. These factors could further strengthen the Mexican Peso.

Outlook and Trading Opportunities:

The outlook for the Mexican Peso remains optimistic, with traders closely monitoring the currency for potential opportunities. The ongoing economic recovery is likely to fuel the Peso’s upward trajectory, presenting favorable conditions for profitable trades.

Conclusion:

The Mexican Peso’s continued strength and positive outlook have captured the attention of traders worldwide. With a resilient economy, decreasing inflation, and enhanced investor sentiment, the Peso is well-positioned to sustain its upward trajectory. Traders looking for promising opportunities in the forex market should closely monitor the Mexican Peso, as it promises substantial gains amidst its impressive performance. However, there is always the risk of political instability. This could weigh on the peso if it leads to uncertainty about the country’s future.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification