Coinbase – a Stock with both risks and potential

By X-blogger - on June 25, 2025

Coinbase (COIN), the largest U.S. crypto exchange, is gaining serious traction—not just from trading volume, but from a booming stablecoin business that Wall Street seems to be underpricing.

Coinbase at a Glance

Headquartered in New York, Coinbase operates a platform for crypto assets, serving both individual consumers and institutions across global markets. With a market cap of around $75 billion, it’s classified as a large-cap stock and continues to dominate the U.S. crypto exchange market, offering trading in over 50 digital assets.

Strong Momentum in 2025

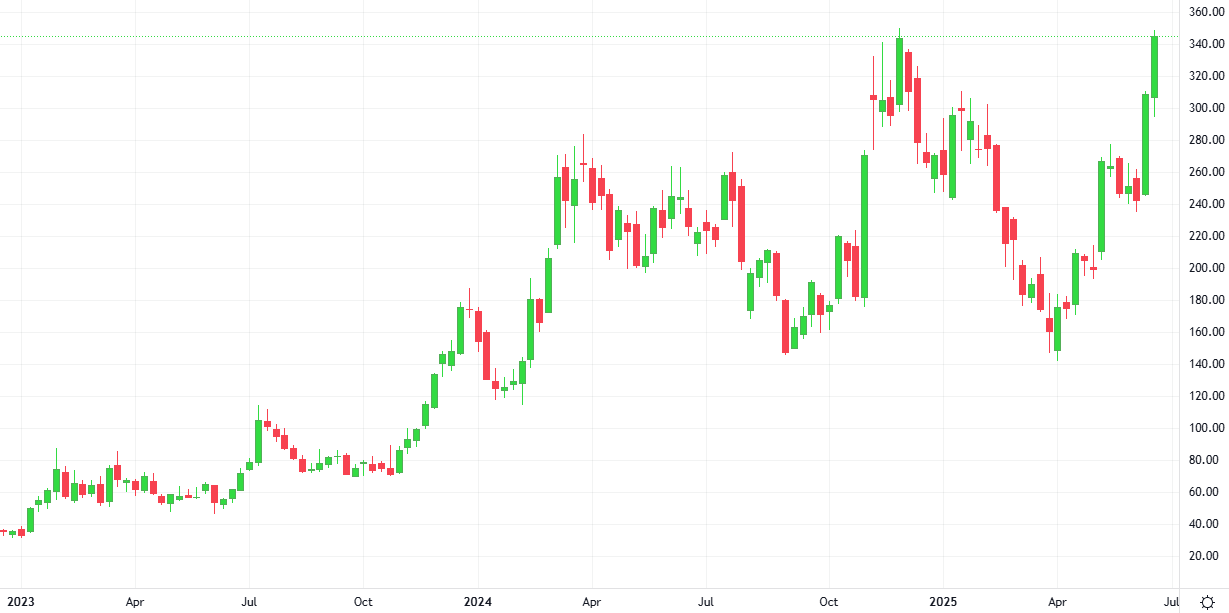

Despite being 15.6% below its 52-week high of $349.75, reached on December 6, 2024, Coinbase stock has rallied significantly in recent months. Over the past three months, COIN has gained 63%, sharply outperforming the iShares Blockchain and Tech ETF (IBLC), which rose just 28.8% in the same period.

Earnings Recap

On a year-to-date (YTD) basis, Coinbase stock is up 18.9%, again outpacing IBLC’s marginal gains. The outperformance becomes even more evident on a 12-month timeline: COIN has surged 25.2%, while IBLC managed only a 2.6% increase.

On May 8, Coinbase reported its Q1 2025 earnings, which gave the stock another boost—COIN rose 5.1% following the report. The company posted $2 billion in total revenue, up 24.2% year-over-year, driven by increases in both transaction and subscription revenues, with $300M (15%) coming from USDC stablecoin income.

While revenue missed analyst expectations, earnings beat them. Adjusted EPS came in at $1.94, a 23.3% decline year-over-year, but still 4.9% above consensus estimates.

The Circle Partnership

Coinbase shares stablecoin profits through its partnership with Circle Internet Group (CRCL), the issuer of USDC. While Circle earns 100% of its revenue from USDC, Coinbase receives 50% of USDC’s total revenue.

Here’s where things get interesting:

CRCL has a current market cap of around $50 billion,

COIN, with a far more diversified and established business, sits at $87 billion.

Yet only 14–15% of Coinbase’s revenue comes from stablecoins, meaning investors may be significantly undervaluing COIN’s core exchange business compared to its stablecoin exposure alone.

What Do Analysts Say?

With a clean balance sheet ($10B cash) and bullish technical pointing to a potential breakout, some analysts expect COIN hitting $500 by 2026. Meanwhile, its stablecoin arm alone is valued less aggressively than pure-play peer CRCL, hinting at a valuation disconnect.

Among the 28 analysts covering COIN, the consensus rating remains a “Moderate Buy.” However, the average price target of $268.61 currently sits below COIN’s actual trading levels, suggesting a potential pause or reevaluation from Wall Street in the near term.

Conclusion:

Coinbase is a crypto stock with both risks and real upside. Between strong earnings, a promising stablecoin catalyst, and a healthy balance sheet, it may be more than just a trading platform—it could be a foundational player in the future of digital finance.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification