Advantages and Future of Automated Forex Trading

By Content-mgr - on May 15, 2016Automated forex trading has limited practical use in today’s markets. Nonetheless, it can deal nicely with some routine trading tasks and off-hours trading.

Beneficial Applications of Automated Forex Trading

Automated forex trading is characterized by low profitability and an overall inherent instability, which prevents it from becoming more profitable. As soon as the user pushes for more profit, by changing the parameters, stability is lost. And ultimately, profitability is short lived once these parameters have been pushed too far. All in all, automated forex trading is no match for manual trading — not by a long short. There are however very specific online trading situations wherein such software-based trading provides a solution. These specific trading needs have to do with off-hours trading, and very strict criteria trades, both of which are too resource-intensive for a human trader to handle. Traders who use automation successfully, and in a stable way, are specialist traders. They do a lot of manual work, working through many charts and markets. And only a handful of limited periods of time are handed over to automated trading. The hard work has already been done prior to allowing the software to trade. The whole purpose of using this software, is to save time. Or to execute very specific trades, where contingent orders have to be of very specific size. Trading software can stand guard for many hours, and only execute the trade in question if and only if the strict criteria are met. This is often the case during major trend reversals and expected market moves. But beyond these applications, automation has failed to deliver superior results.

High Frequency Automated Forex Trading

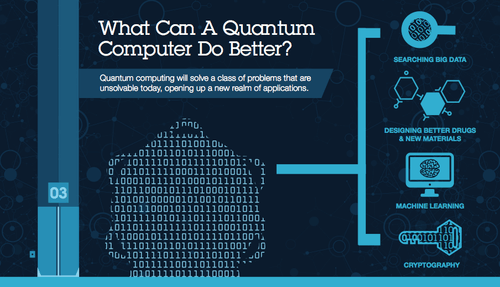

High frequency automated forex trading is a more realistic possibility, but it still is in its infancy. Developers of any such successful and stable trading systems are unlikely to make them available for sale. Such high frequency trading still suffers from changes in market volatility. Which just like in the case of scalping end up causing very large losses when they happen. Day trading forex live through a high frequency, automated approach is a realistic possibility. Developers however lack the analytical skills required to model volatility and other risk factors, in a mathematical way. And as with all algorithms, if the theory is not correct the software end-product will not work well either. Software products such as forex robots are capable of winning forex trading competitions and producing large profits. But success is short-lived. And after several weeks the algorithm starts to fail miserably. And it even risks losing big money. If a forex robot was very good. And it only needed manual parameter adjustment about once a week, it could keep on working well. But this parameter adjustment would be so complicated and very few clients could possibly handle it. So is trading online made easy by automation? The answer is, YES, but only in very specific circumstances. Mathematicians on the other hand believe that the supercomputers of the future, relying on quantum processors, will generate impressive results. They will be able to run high frequency trading software much better. And parameters may only need to be occasionally tweaked, by data algorithmiscists.. These systems will still fail at some point, but they will have much longer winning streaks than today’s systems. It remains to be seen how the mathematics of pattern recognition will benefit from quantum computing.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification