March 2, 2026

March 2, 2026

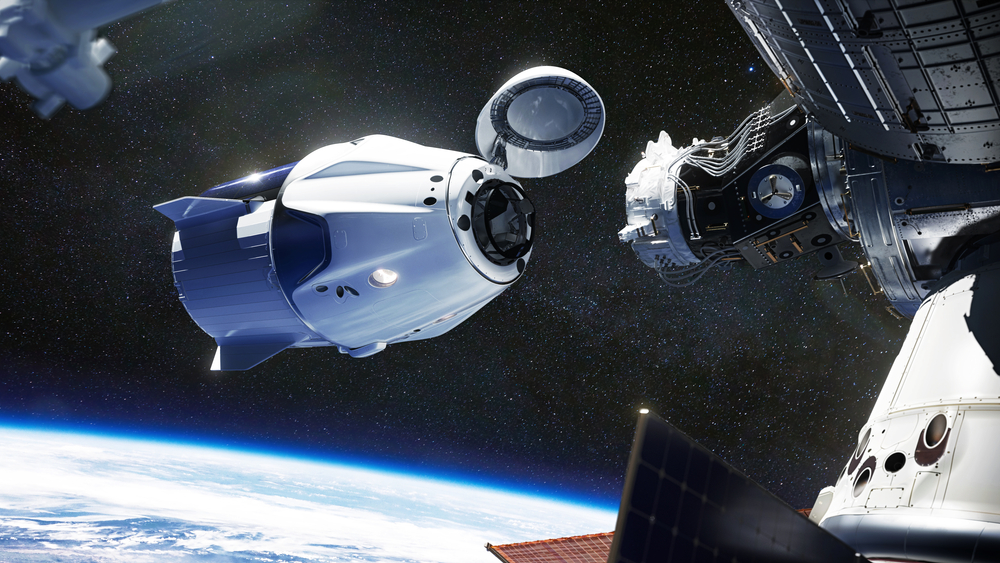

SpaceX could seek IPO valuation of over $1.75 trillion

Elon Musk’s SpaceX is aiming to file confidentially for an initial public offering that could value the rocket and satellite company at more than $1.75 trillion. The filing could come as soon as this month.

Read More

March 2, 2026

March 2, 2026

Wall St notches monthly declines on combined AI, tariff, geopolitical uncertainty

Financial and tech stocks were hit hard by a handful of persistent investor worries on Friday, with U.S. stocks suffering their largest monthly percentage declines in a year. All three major indexes ended decisively lower and posted steep weekly declines.

Read More

March 2, 2026

March 2, 2026

Tether says it has frozen $4.2 billion of its stablecoin

El Salvador-based stablecoin issuer Tether said it has frozen about $4.2 billion of its crypto tokens over links to “illicit activity”, mostly in the past three years, as authorities around the world try to crack down on crypto-related crime.

Read More

February 26, 2026

February 26, 2026

Gold climbs as tariff and geopolitical risks spur safe haven demand

Gold gained as investors moved into safe havens on concerns that tariffs could stoke inflation, while ongoing tensions between Iran and the United States also kept bids for safety intact.

Read More

February 26, 2026

February 26, 2026

FTSE 100 closes at fresh high after HSBC raises earnings target

Britain’s FTSE 100 closed at a fresh peak after HSBC lifted a key earnings target and miners hit new highs, as fading worries over AI’s disruption to traditional businesses lifted global sentiment.

Read More

February 26, 2026

February 26, 2026

Circle beats Q4 earnings estimates as USDC supply jumps 72%

Stablecoin issuer Circle Internet Group reported stronger-than-expected fourth-quarter earnings, driven by rapid growth in its USDC stablecoin business and expanding payments operations, underscoring continued momentum in an otherwise challenging crypto market.

Read More