CFD Trading Strategies for Beginners to Trade Like an Expert!

By Content-mgr - on November 27, 2016Some CFD trading strategies for beginners really could help many clueless traders improve their trading. And even quite possibly turn from losers into winners.

Best CFD Trading Strategies for Beginners

The best CFD trading strategies for beginners rely on basic probability analysis and basic well proven tips. Most online CFD training courses focus too much on the wrong stuff. As well as on naive trading theories, which cannot withstand real trading conditions. These courses provide a sense of comfort to beginners, but most of what they teach is downright wrong! Beginners should focus instead on flexible trading systems and strategies. And always take probability theory into account. Probability theory is counter intuitive in its results, but it does reveal facts closer to the truth. In doing so, new traders will have to break some of the classic trading rules, and be bold enough to apply critical thinking. So as to challenge their mentors and educators. Trading CFD for dummies kinds of courses on the other hand, are useful for understanding CFDs and some of their inner workings. CFDs have simple pricing structure, and simplicity is one of their advantage. These CFD courses are only the basis for getting into CFD trading. They are important because traders can get to see how CFDs are used to hedge market risk very efficiently. As beginner traders move on, away from the basics, they will have the chance to think for themselves and decide which practices to keep and which ones to ignore.

CFD Trading Strategies for Beginners who Want to Keep Things Simple

Keeping things simple is nice, but unfortunately things are never too simple in trading. Simple things can turn into complicated problems in no time. CFD trading strategies for beginners could be greatly improved if the student trader forgets all about disciplined trading and mechanical approaches to the markets. The good part of these strategies is probably in the way that educators teach you how to pick entry points. This part of their methodology is usually good, but again one has to add more flexibility. Which means using larger stops, than the ones educators recommend. Today’s CFD trading platforms make it easy to embrace risk, through the linear pricing of CFDs. Which means accurate hedging and great flexibility. There is absolutely no reason to use tight stops in today’s markets, in fact very few strategies use tight stops. None of which is of beginner level. Online CFD brokers facilitate smooth, fool proof trading because their platform designers have anticipated the mistakes a rookie trader will make. All in all, great flexibility is offered through simplicity and fool-proof design. CFDs however meet the needs of a wide range of traders. From beginners to very sophisticated traders.

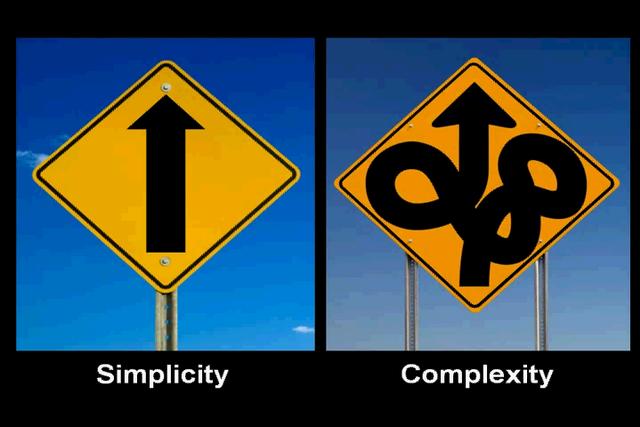

Simple or Sophisticated, which Makes More Money?

In the financial markets, the most advanced traders actually use multi-strategies, which combine both extreme aspects of trading. Both simple and complicated. A simple strategy for example may be based on a 10 day moving average and the market closing value of the last 3 days. An advanced strategy could be based on trading volume, active or inactive market hours, and LSS pivots. And throughout the trading week, both such strategies may be used to infer entry points to the market. Sometimes the simple wins over the complicated. And sometimes the simple needs time to consolidate before catching up with the market again. Wise CFD traders actually use both simple and complicated concepts.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification