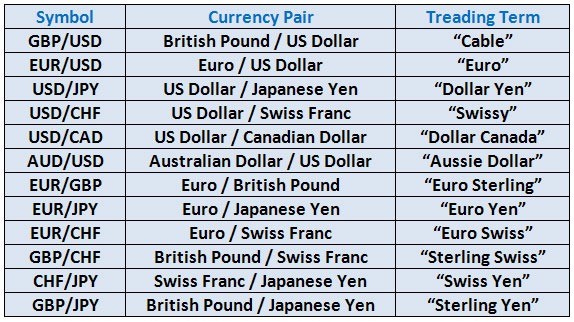

Using a Foreign Exchange Currency Symbols Table

By Content-mgr - on August 3, 2016A foreign exchange currency symbols table provides all basic currency structure at a glance. So that the trader can see which currency pairs are likely to be correlated with one another. And to make better decisions as to what to trade. It’s important when trading many currency pairs, not to fall into the traps of correlations. Because open trades will tend to lose or win all at the same time, which is a problem from an account margin point of view. A foreign exchange currency symbols table helps check various currency pairs, and even bring more currencies into the equation, so as to risk possible risk when necessary. So that if the trader for example happens to trade EURUSD and GBPUSD, they can also consider trading EURGBP when needed. As a way to specifically trade price movements in the Euro and the British Pound, in isolation from the US dollar. And this is only an example, in reality there are many days around the year, where a trader may have to switch to another currency pair. So that profits are maximized. Wise currency trading strategies require the trader to know how to handle unexpected risk, and even how to temporarily hedge that risk. Such risks appear in the market all the time, and day trading forex live does require taking quick action. But this in turn requires that the trader chooses the optimal, best suited currency pair on that day.

A Foreign Exchange Currency Symbols Table May Seem Confusing

A foreign exchange currency symbols table may seem confusing to some traders, in the way that one pair relates to another. And risks are well hidden, as correlations are evident in the long term only. And correlations can be enormously deceptive and difficult to figure out. But for specific day trades, it is possible to capture a move in one currency pair, by trading another pair as a proxy. And this is because that other pair may provide more price movement. The analysis is one and the same, and based on few key currencies. But trading one single pair all the time may limit the trader’s ability to maximize profits and minimize risks. That’s why knowing the relations among currency pairs can be so useful. Ideally one wants to know how to use different pairs for proxy trading, as they practice currency trading one day at a time. Especially in day trading forex live, where trades last minutes rather than many hours.

The Risks of Correlation and Proxy Trading

The risk lies with correlation trading, so that EURUSD and GBPUSD for example are correlated, but far from perfectly. Such correlations come and go from time to time, and it is possible for certain events in the markets to break the patterns entirely. Stronger correlations exist between commodities and currencies, such as the one between crude oil and USDCAD (strong negative correlation). Traders need to know what they are doing and know the risks. The important thing to remember is that correlations are long term, and may fail catastrophically in day trading and even in medium term trading. Whereas bringing in a 3rd currency pair, to trade the daily impact on two other pairs, such as in our example above, does work for day to day trades and day trades. Because if you look at them as fractions, we simply trade the movement between the nominator parts.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification