Best Forex Trading Hours

By Content-mgr - on March 27, 2016Currencies tend to make their intraday moves at particular times. Detecting these forex trading hours helps avoid choppy, flat price action and false entries.

Best Forex Trading Hours for Day-Traders – Swing Traders

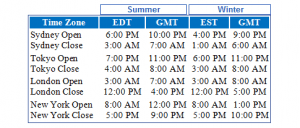

The best forex trading hours especially for day-traders are found around the time where each particular exchange opens around the world. Even though the forex market is decentralized, and live forex rates keep on moving up and down, from Monday through to Friday. Trading activity is concentrated around those hours at the open, or soon after the open. These patterns are not permanent, the currency pair in question may change behavior later, and act differently. But the general pattern is that particular currency pairs tend to at least make their significant moves during the trading time at a particular localized market. This time is essentially the time where all markets, commodities and stocks etc, are actively traded. The best forex trading hours are the ones that offer maximum trending action, if you are a momentum trader. Or the hours that offer almost trendless price action, if you are a scalper. EURUSD for example, is best traded by scalpers during the Asian trading session, because for few hours both European and US trading activity falls to a minimum. There is trading going on, but there are no news announcements during these hours on EURUSD, and news is what triggers those 60pip or 180pip intraday movements. Scalpers are directionless traders, who simply establish a baseline (as in the EURUSD example), which is good for few hours, and then they simply buy dips and sell rallies around that baseline. Day trading forex is very exciting during price trending hours, because the market moves by many pips, fast. This requires skill and preparation, but those who can, do make consistent profits throughout the week.

Best Forex Trading Hours for Hedgers

Hedgers are traders who combine a long term trade, together with many smaller trades in the opposite direction. Usually through a CFDs trading account. The best forex trading hours for hedging are of course the trending hours in the market. Hedgers are more relaxed than day traders because take less overall risk. If the hedging trade loses money, the larger longer term trade is at a profit. Depending on the hedging used, and whether it is dollar for dollar, hedgers may actually hedge the primary losing hedging trade as well. If their belief is that the market will not trend over few days, they see it as a sideways market, and hedge open losing trades. Because the timing is greatly improved through this kind of carefully selected trading time, the overall risk is greatly reduced. After all, successful trading is about staying in the trade for less time, and dedicating more time studying the market. CFD forex brokers make it possible to trade efficiently, and to actually hedge long term trades and investments. Which is a good thing to do, as markets may remain flat or in sideways trading patterns for many months at a time.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification