How to Trade Forex Profitably in the Long Run

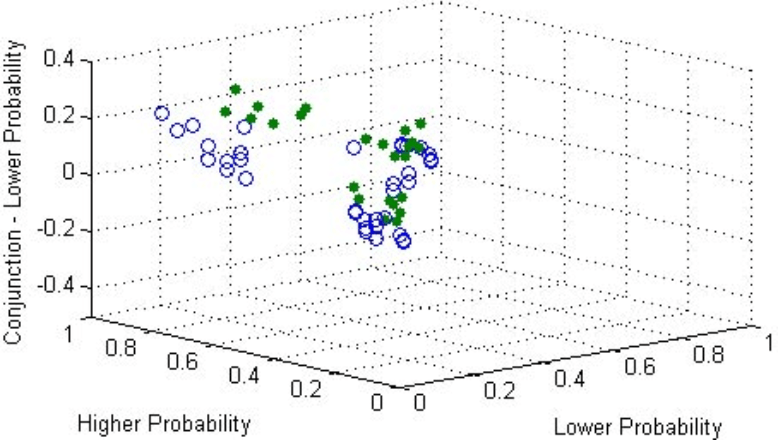

By Content-mgr - on May 25, 2016All traders who know how to trade forex profitably, base their ideas and strategies on probability, and statistics over large samples of data. Day traders tend to use disciplined trading methods, having many limitations. Whereas swing traders treat each and every trade in a unique way, as if it never happened before. And even though they treat each trade differently, they still base their ideas on probability. In simple mathematical terms, a factor which favors the trade going well is expressed as a number over 1. And a factor which suggests that the trade will turn out to be a loser is expressed as a number less than 1. By assigning appropriate weight to each such factor, for example 1.05, 1.09, 0.95, 0.8 etc. The overall risk can be assessed in a crude but meaningful way. The actual probability of the trade going well or not will depend on the final algebraic product of these numbers being greater than 1 or not. And this whole approach requires a calibration of the numbers around past profitable trades. Even the best forex trading strategy, unbeknownst to the actual user, can be expressed in terms of basic probability theory. So every forex trader can in fact use probability theory to some degree, to figure out things that would other have remained hidden. Oftentimes, the whole secret of success in a well-calibrated probability based trading strategy, is whether a factor is 0.95 or 1.05. This little difference on a couple of indicators can make all the difference on the trade. Data analysis and processing can successfully model the physical world, and financial trading too. In other more sophisticated models, probability theory attempts to predict market direction over the next 30 to 40 minutes. And it has succeeded in doing it. This is how some traders learn how to assess risks, and how to trade forex profitably in the long run. Because visual observation alone is not enough to assess the risks, not unless one is extremely experienced.

How to Trade Forex Profitably and Wisely

Those who know how to trade forex profitably and more wisely than most, rely more or less on the same indicators that every body else is using. The difference is that they have assigned a different weight of importance to each one of these indicators. So they know when to fade an indicator which they followed very closely in the days before, and when to follow it again. This complexity of the forex market is the whole task of trading. Only few know how to handle it and navigate through it. Most forex courses offer tips and methods which fail to address this complexity, and as a result attendees of these courses learn very little information. Complexity makes the markets more interesting and trading non-routine, which is great as nobody likes routine tasks. But this riddle, that the complexity of indicators presents, is overwhelming to new traders, and makes them lose. And when one has been losing money trading for too long, may end up losing faith. And yet the same traders have a lot of faith in their infant skills when first handling complexity. This kind of naive wishful thinking is what makes people see the world from a distorted probability perspective, rather than a realistic one. So that the probability of winning the lottery seems high, but an equally likely form of cancer somehow seems less probable. Successful traders put probability ahead of wishful thinking, and welcome all adverse moves in the market. They are always reminded that market price will follow the path of maximum confusion. And that’s all they need to start their analysis. Long before they put faith in their forex trading business opportunity.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification