What is CFD Trading Best Used For

By Content-mgr - on December 14, 2015What is CFD trading and how it can benefit you as a trader. The key advantages of CFDs are found in efficiency and flexibility not in their leverage.

What is CFD Trading in a Nutshell

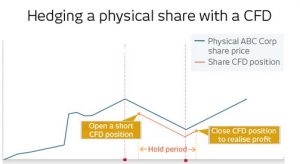

Leverage is offered today in many trading instruments, there is nothing magical about it. Many traders are still not fully aware of what is CFD trading and how it works. Basically CFDs are derivative financial instruments which allow you to profit from market movements, but without owning or committing to own (buy or sell) the underlying asset at any time. CFD online trading has become popular among seasoned traders who trade commodities and currencies, as well as stocks. As far as stocks are concerned, CFDs provide tax planning flexibility, the advantage of being able to short a stock at any time, as no short selling restrictions ever apply, and the advantage of liquidity.

Because of better, one way liquidity, trading is faster and more efficient through CFDs than it can be through any other instruments. The spot markets (Forex and Commodites), as well as the Futures markets suffer from inherent problems, they all can be dealt with, except the issue of liquidity. A forex trader trading the spot market can find themselves in poor liquidity conditions, but a CFD forex trader will always be able to trade fast and at normal or near normal speed. As long as one trades up to $100 per pip, in the forex market, which most traders do, going with CFDs is much better. The forex spot market has its own pros and cons, and some prefer to trade through advanced and more costly ECN brokers, but these are million dollar forex traders. When one trades at $100 per pip or less, it’s just as efficient but much more affordable to trade through CFDs. Stock traders too, unless one trades stocks with very large amounts of money, there is no reason not to trade through CFDs instead. Plus they will have the short selling advantage when short selling restrictions are imposed.

Options VS CFDs

Options are complicated trading instruments for advanced hedging and neutral strategies. Options are good in some cases, where the trader knows what they are doing and trading is done efficiently. But Options require significant price movement, as well as knowing the volatility. The trader has to get both the market direction right, as well as the volatility. And as a result most new traders end up losing money even though they predict the market right. CFDs on the other hand are extremely efficient by themselves, if the trader makes a right prediction, no matter how small, they will make a profit right away. Many seasoned Options traders use CFDs in their complex strategies, combining both Options and CFDs, as opposed to using just Options, or Futures. So the question is what is CFD trading going to offer you as a small to medium size trader? It is going to offer you amazing trading efficiency, protection from adverse liquidity, and all the day to day liquidity you will ever need. CFDs protect from adverse spot market liquidity, just like a harbour protects ships from massive waves coming through from the ocean, but it still allows you to be in touch with the spot market indirectly, in a strongly favourable way. Liquidity is perfect for up to $100 per pip, in all currency pairs. Spot market forex traders are always at risk, because even the most liquid pair, such as EURUSD, can become illiquid during brief periods of time. CFD trading platforms are easy to use, and they make it possible to capture fast market movements just like you see them happening on your forex charts. The fact that seasoned stock Option traders use CFDs in their trading, instead of Futures or Stocks, speaks volumes. It is because CFDs provide the efficiency for fast, directional profiting which Options and Futures always lack.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification