The Canadian dollar weakened to a seven-week low against its U.S. counterpart on Tuesday as the price of oil fell 4% and investors reassessed the outlook for Federal Reserve interest rate cuts.

The Canadian dollar weakened to a seven-week low against its U.S. counterpart on Tuesday as the price of oil fell 4% and investors reassessed the outlook for Federal Reserve interest rate cuts.

Oil prices rose more than 3%, with Brent surpassing $80 per barrel for the first time since August, as the increased risk of a region-wide Middle East war jolted investors out of record bearish positions amassed last month.

The Oil-Dollar pair exploded 4.5% in the last session. The CCI indicates an overbought market.

Support: 72.8667 | Resistance: 74.2667

Global cryptocurrency adoption is approaching a significant milestone, with 7.51% of the world’s population now using digital currencies, according to a report by MatrixPort. The report projects this figure to exceed 8% by 2025, signaling a potential shift of crypto from a niche market into mainstream financial systems.

The last session saw the Aussie fall 0.6% against the Dollar. The ROC is giving a negative signal.

AUD dropped 0.6% against USD in the last session.

The ROC is currently in the negative zone.

Support: 0.6773 | Resistance: 0.6821

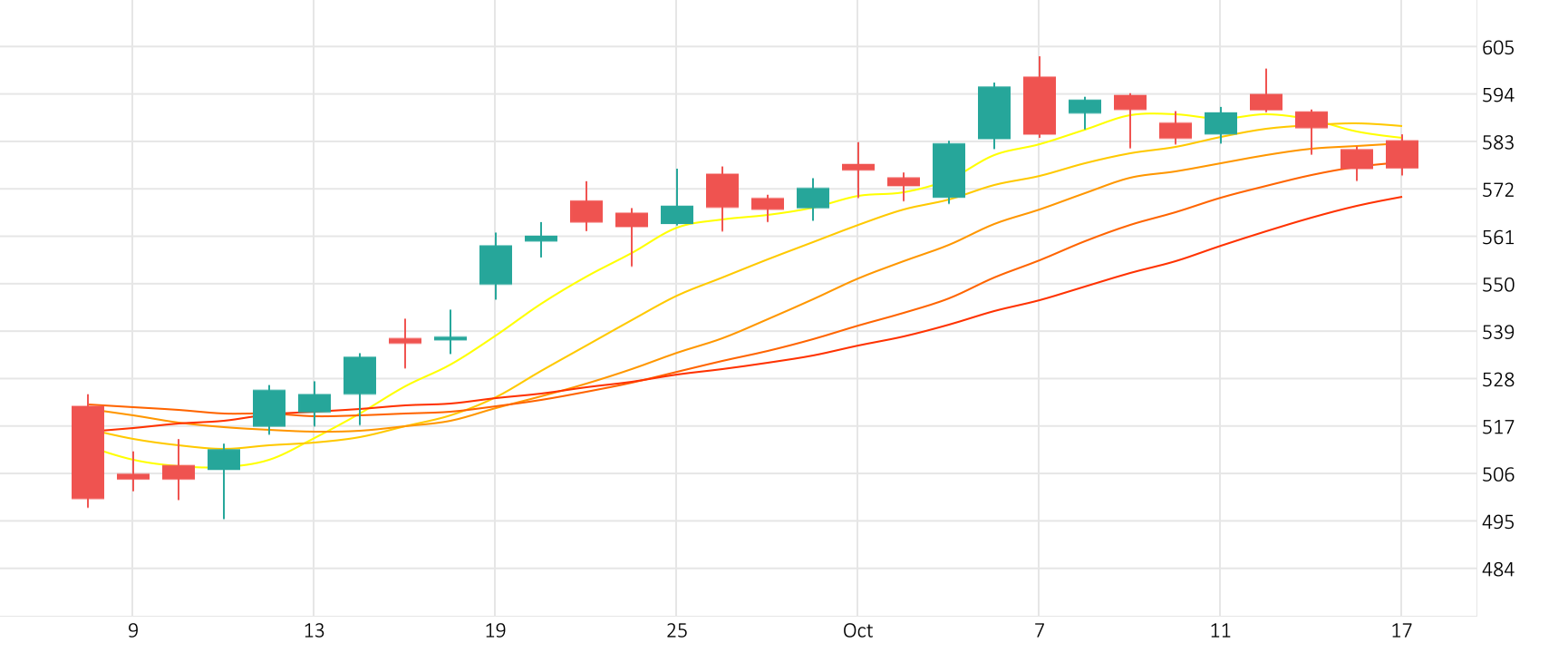

Meta shares gained 2.0% in the last session. The MACD is giving a positive signal.

Meta’s stock gained 2.0% in the last session.

The MACD is currently in positive territory.

Support: 563.6567 | Resistance: 592.9167

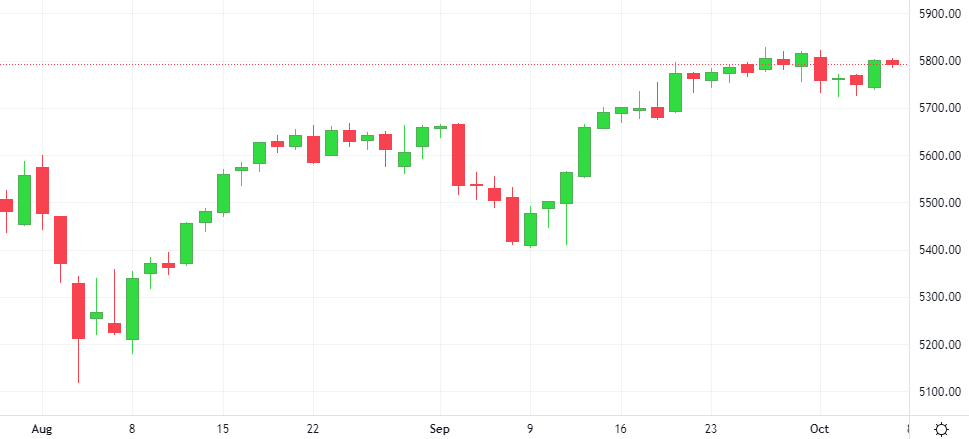

A high-stakes corporate earnings season kicks into gear this week, with bullish investors hoping results will justify increasingly rich valuations in a U.S. stock market near record highs. The case for strong U.S. economic growth got a boost after labor market data came in far above expectations. The S&P 500 is up 20% year-to-date and stands near record highs