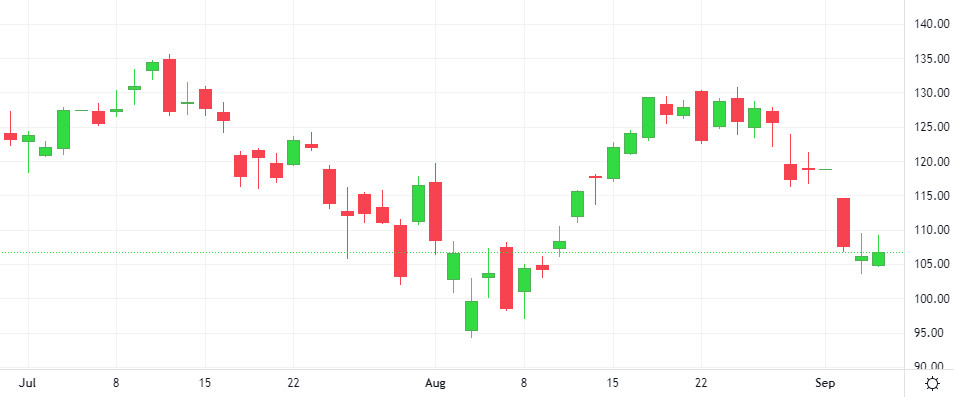

Treasury yields and the dollar fell while the Dow registered a record closing high as a subdued U.S. inflation report lifted expectations of an outsized interest rate cut at the Federal Reserve’s November policy meeting. A global stock index also reached a record high, helped by China’s stimulus boost, and European shares posted an all-time high close.

The Federal Reserve is likelier than not to deliver a second 50-basis-point interest rate cut in November, traders expect, after a government report showed U.S. inflation has cooled to a pace nearer to the central bank’s 2% goal.