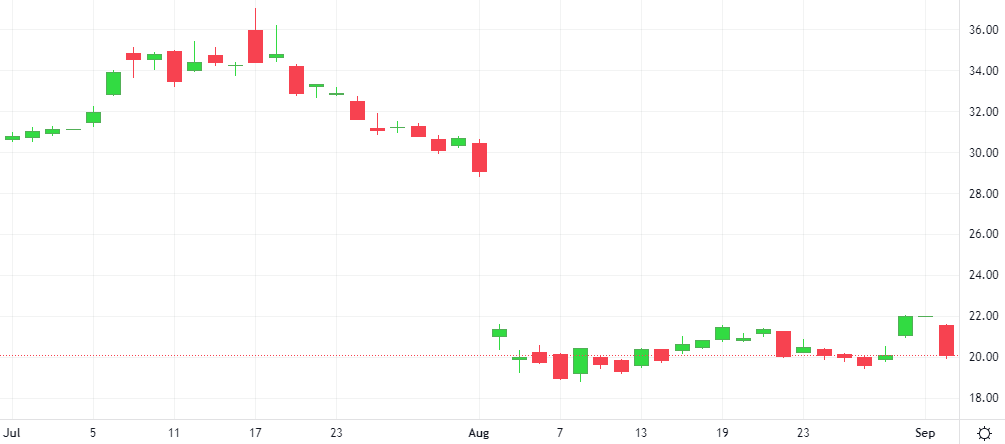

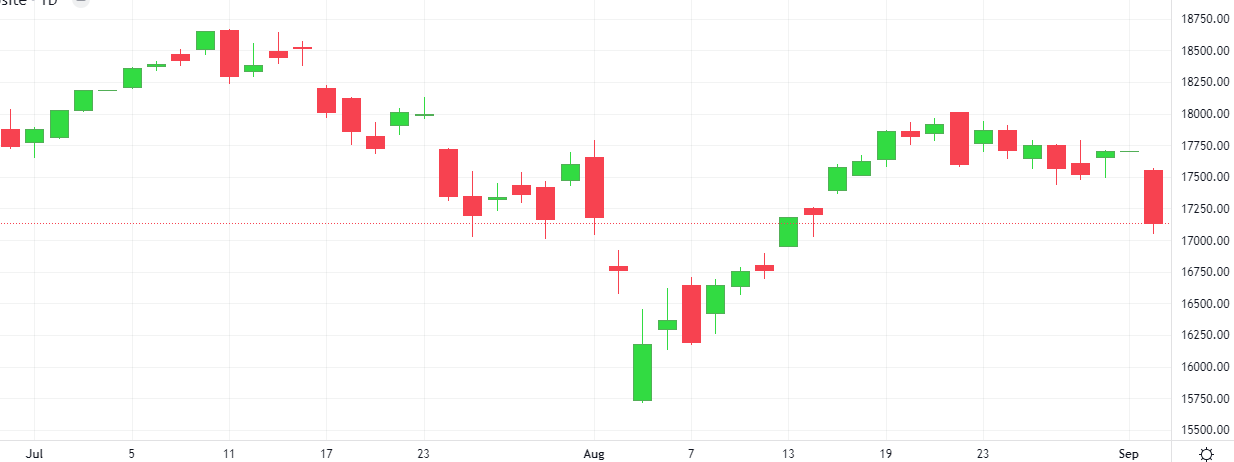

Bitcoin could be heading to a correction below $54,000 after the global crypto market capitalization fell below a key psychological level. The global crypto market capitalization fell below the $2 trillion mark after decreasing 3.46% within 24 hours.

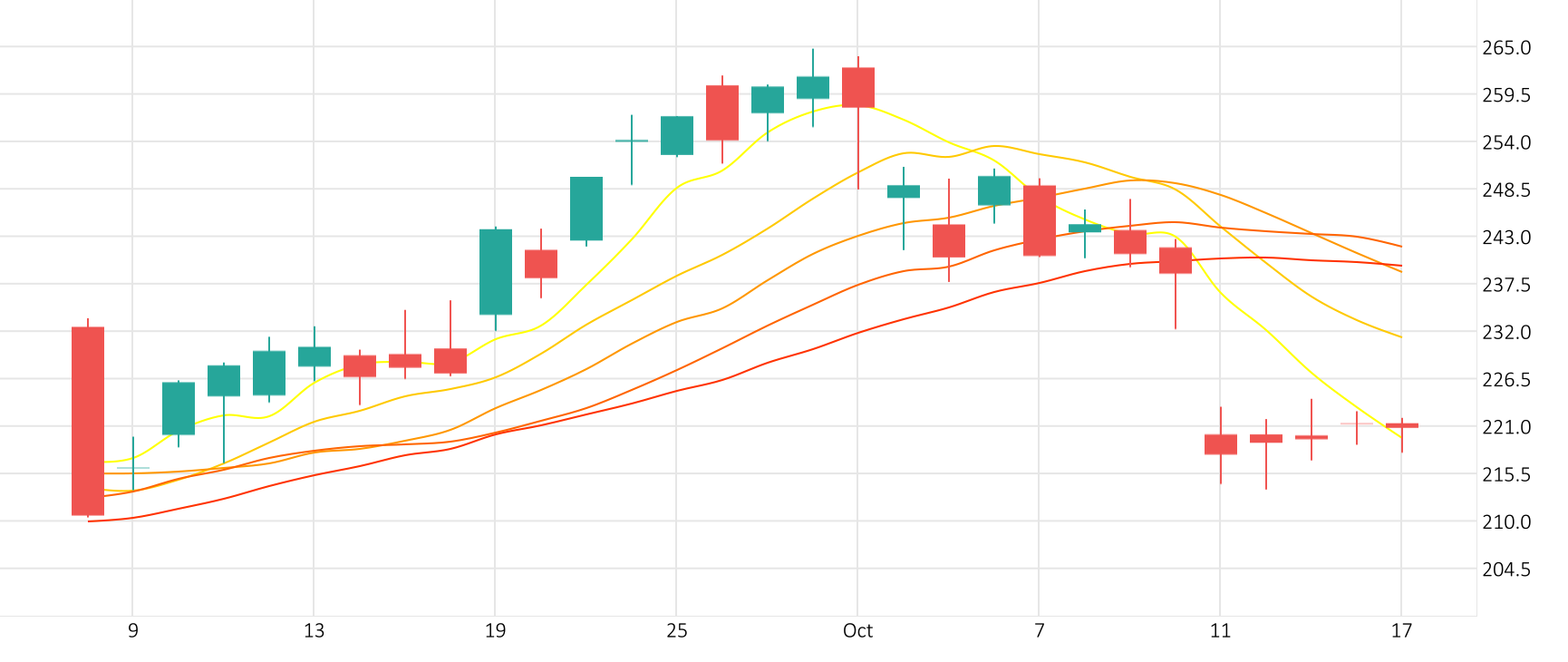

The last session saw the Bitcoin gain 0.7% against the Dollar. The MACD is giving a negative signal.

BTC/USD gained 0.7% in the last session.

The MACD is giving a negative signal.

Support: 560561 | Resistance: 607881