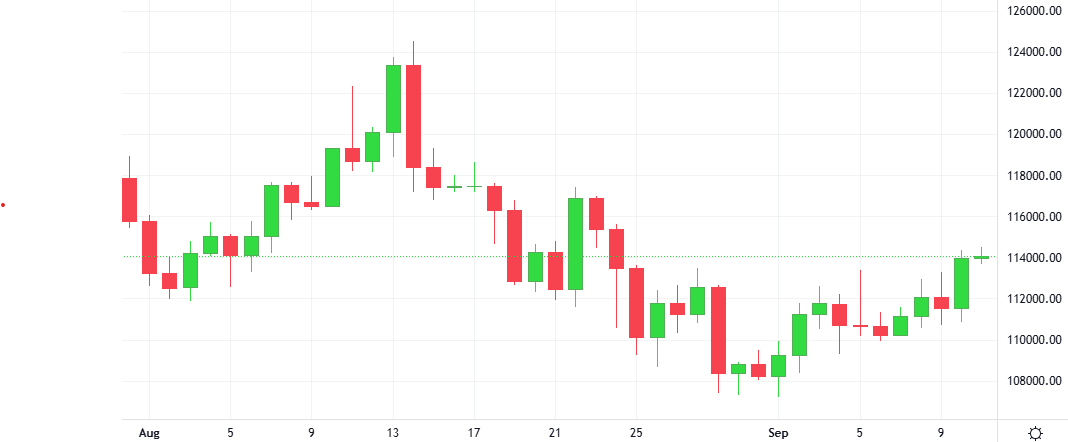

Bitcoin surged above $114,000 for the first time since August 24, extending its recent recovery as US inflation data came in far cooler than expected. The move follows the release of the August Producer Price Index , which dropped to 2.6% year-over-year