General Motors is cutting output at one of its main electric-vehicle factories, the latest automaker to pull back on EVs as U.S. President Donald Trump’s administration yanks federal support for green cars.

General Motors is cutting output at one of its main electric-vehicle factories, the latest automaker to pull back on EVs as U.S. President Donald Trump’s administration yanks federal support for green cars.

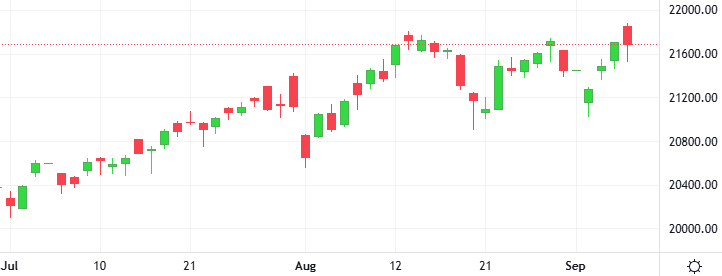

The three major U.S. stock indexes were higher as labor market data did not change expectations for an interest rate cut by the Federal Reserve this month. Shares of chip company Broadcom, considered a key artificial intelligence player, were up 1.2% ahead of its quarterly results

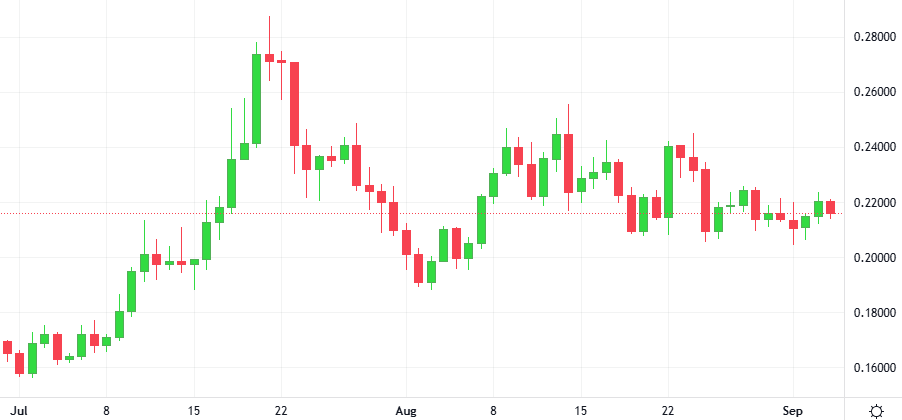

KuCoin cryptocurrency exchange is aiming to capture 10% of the blockchain mining capacity behind the world’s largest memecoin, the Dogecoin network, through the launch of a new cloud mining platform.

U.S. job openings fell to a 10-month low in July and there were more unemployed people than positions available for the first time since the COVID-19 pandemic, data consistent with easing labor market conditions and supporting expectations the Federal Reserve would cut interest rates this month.

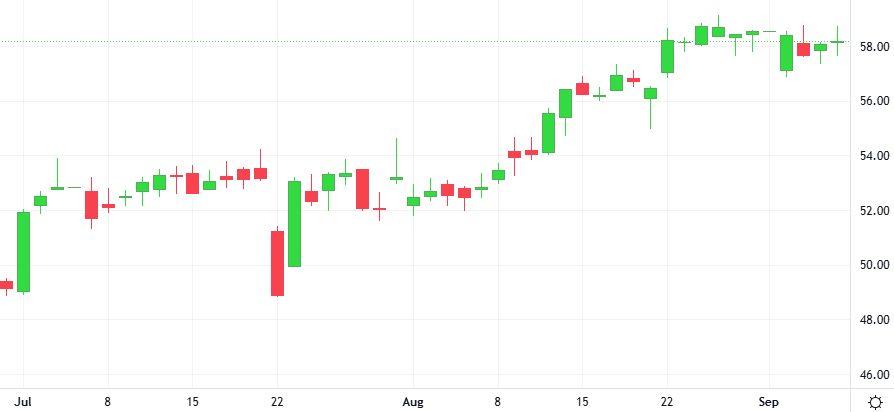

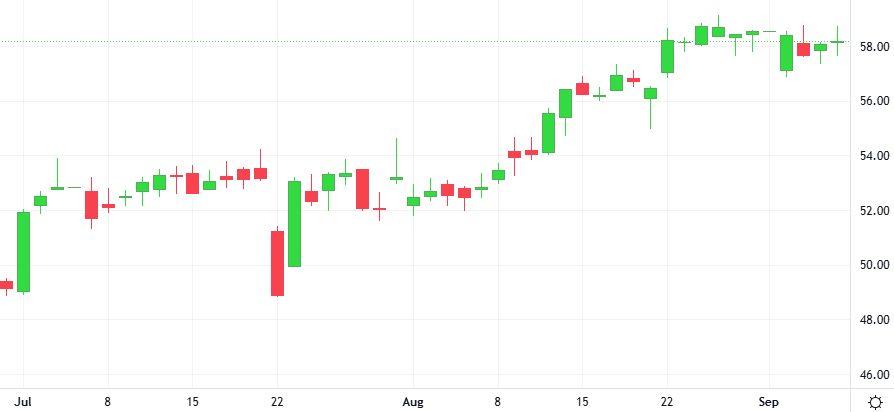

Oil prices settled down more than 2% ahead of a weekend meeting of OPEC+ producers that is expected to consider another increase in production targets in October. The prospect of OPEC+ raising oil production has increased ahead of the meeting.

Britain’s 30-year borrowing costs rose to their highest levels since 1998 and sterling slid over 1.5%, highlighting growing investor anxiety about the UK’s ability to keep its finances under control.