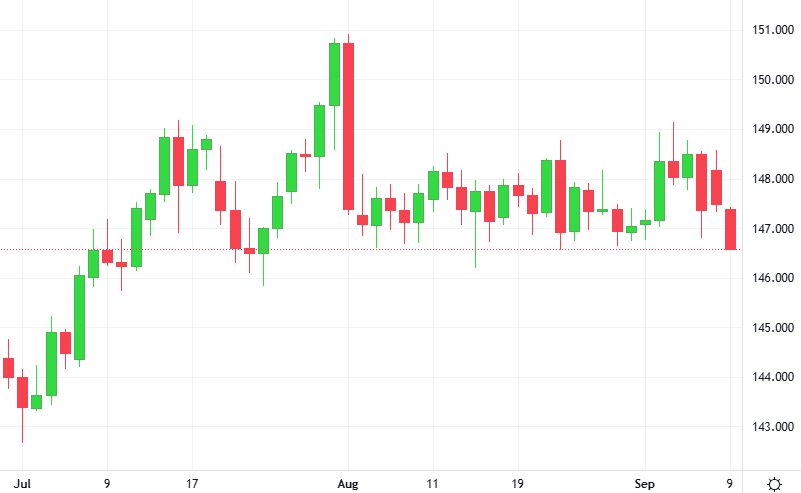

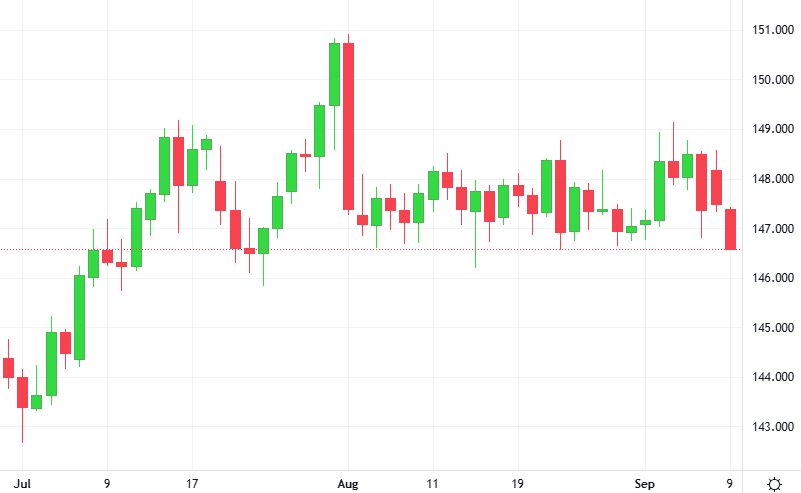

The dollar extended its decline in the wake of Friday’s weak U.S. jobs report, which all but cemented an interest rate cut this month, even as the yen fell after Japanese Prime Minister Shigeru Ishiba announced his resignation over the weekend.

The dollar extended its decline in the wake of Friday’s weak U.S. jobs report, which all but cemented an interest rate cut this month, even as the yen fell after Japanese Prime Minister Shigeru Ishiba announced his resignation over the weekend.

Gold surged past the $3,600 an ounce level for the first time, hitting a record high, as soft U.S. labor data reinforced expectations the U.S. Federal Reserve will cut interest rates next week.

The U.S. dollar fell sharply against major peers to end last week after crucial monthly jobs data showed that American employers hired fewer workers than expected, which affirms weakening labor market conditions and likely guarantees a Federal Reserve interest rate cut.

U.S. job growth weakened sharply in August and the unemployment rate increased to nearly a four-year high of 4.3%, confirming that labor market conditions were softening and sealing the case for a Federal Reserve interest rate cut later this month.

Robinhood Markets will replace casino operator Caesars Entertainment in the benchmark S&P 500, marking a pivotal moment for the financial technology sector as the retail trading platform joins the ranks of the most influential U.S. companies.

Stablecoin issuer Tether, the creator of USDt, has begun discussions with mining and investment groups about deploying capital across the gold supply chain. The move would further diversify Tether’s portfolio risk.

Big crypto investors, or whales, were suffering millions in losses on the Trump family-linked World Liberty Financial token, which continued to decline despite a proposal to reduce the circulating supply.