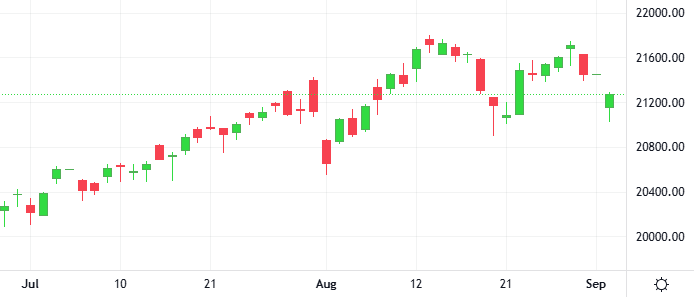

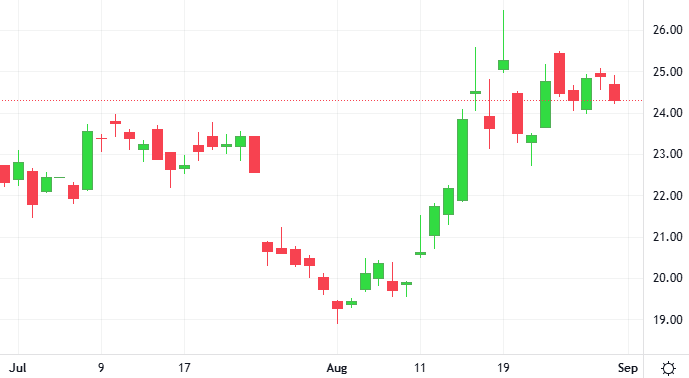

Wall Street’s main indexes tumbled to a more than one-week low on Tuesday, as investors returning from a long holiday weekend confronted fresh uncertainty over the legality of President Donald Trump’s tariffs.

Wall Street’s main indexes tumbled to a more than one-week low on Tuesday, as investors returning from a long holiday weekend confronted fresh uncertainty over the legality of President Donald Trump’s tariffs.

Gemini, a crypto exchange founded by Cameron and Tyler Winklevoss, announced the launch of an initial public offering of 16.67 million shares of Class A common stock. Gemini is planning to sell the shares priced between $17 and $19 per share, to raise up to $317 million.

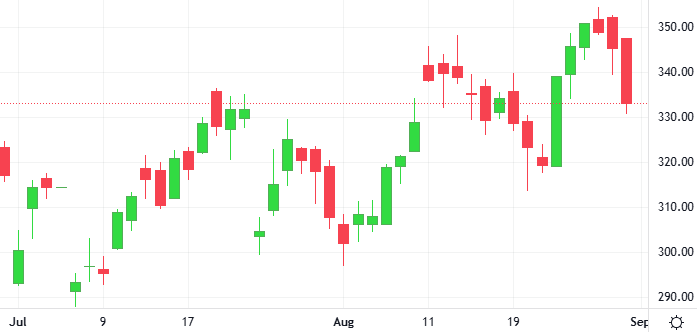

Tesla’s sales rout in some European markets extended to an eighth month in August amid mounting competition from both Chinese EV rivals and traditional automakers, as well as a backlash against CEO Elon Musk’s courting of far-right parties.

Cryptocurrency investment products attracted renewed inflows last week, offsetting the prior week’s $1.4 billion outflows. Crypto exchange-traded products logged $2.48 billion in inflows last week, data from CoinShares showed.

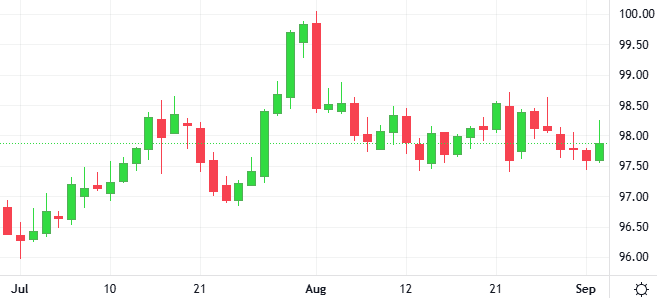

The dollar hit a 5-week low as investors looked ahead to a raft of U.S. labour market data this week that could affect expectations for the Federal Reserve’s monetary easing path.

Traders were also assessing Friday’s U.S. inflation figures.

Intel said it amended the CHIPS Act funding deal with the U.S. Department of Commerce to remove earlier project milestones and received about $5.7 billion in cash sooner than planned. The move will give Intel more flexibility over the fund