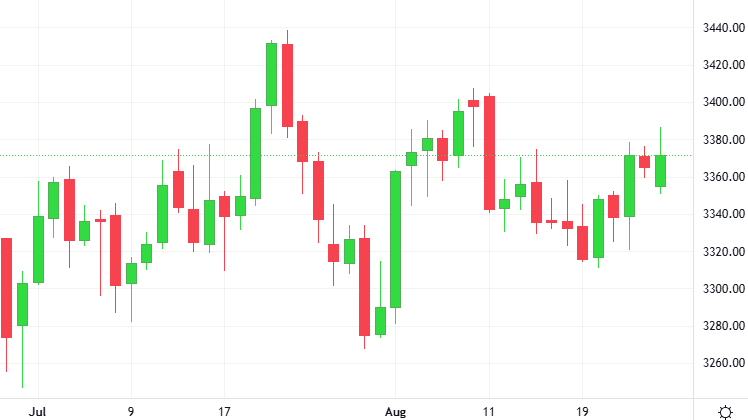

Britain’s FTSE 100 closed lower, snapping a five-day winning streak as global markets went into a risk-off mode after U.S. President Donald Trump said he was firing Federal Reserve Governor Lisa Cook.

Britain’s FTSE 100 closed lower, snapping a five-day winning streak as global markets went into a risk-off mode after U.S. President Donald Trump said he was firing Federal Reserve Governor Lisa Cook.

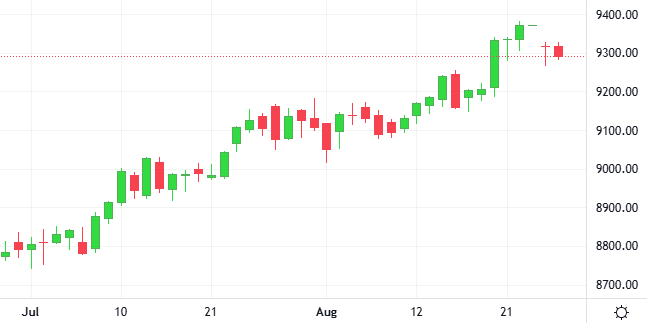

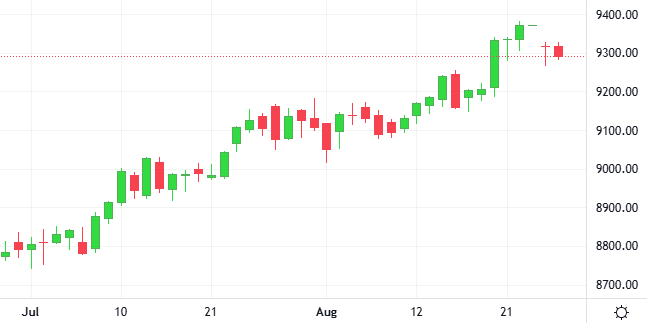

Spot Bitcoin exchange-traded funds ended a six-day streak of net outflows on Monday, with $219 million in daily inflows. Fidelity and BlackRock ETFs led the rebound, driving a majority of the daily net inflows.

Oil prices climbed around 2%, continuing last week’s gains, as traders anticipated more U.S. sanctions on Russian oil and Ukrainian attacks on Russian energy infrastructure that could disrupt supplies.

Gold prices held steady, as the market’s focus shifted to upcoming U.S. PCE data for cues on the Federal Reserve’s policy path, while a stronger dollar capped gains.

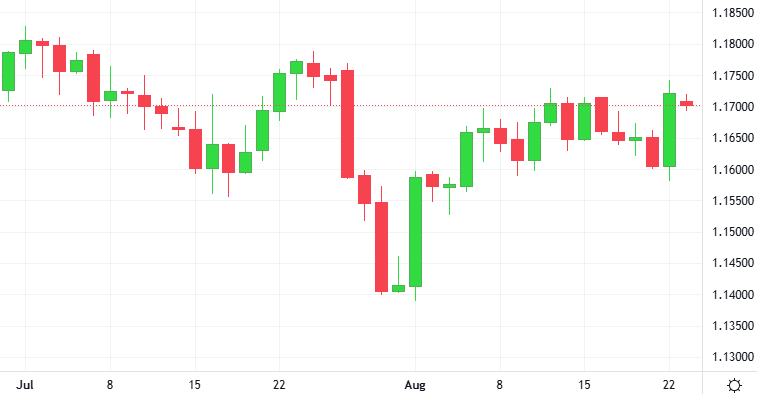

The European Central Bank is likely to keep interest rates on hold next month but discussions about further cuts may well resume in the autumn if the economy weakens. ECB President Christine Lagarde said in July the euro zone’s central bank was “in a good place” as it left its key rate at 2%.

President Donald Trump said the U.S. would take a 10% stake in Intel under a deal with the struggling chipmaker that converts government grants into an equity share, the latest extraordinary intervention by the White House in corporate America.