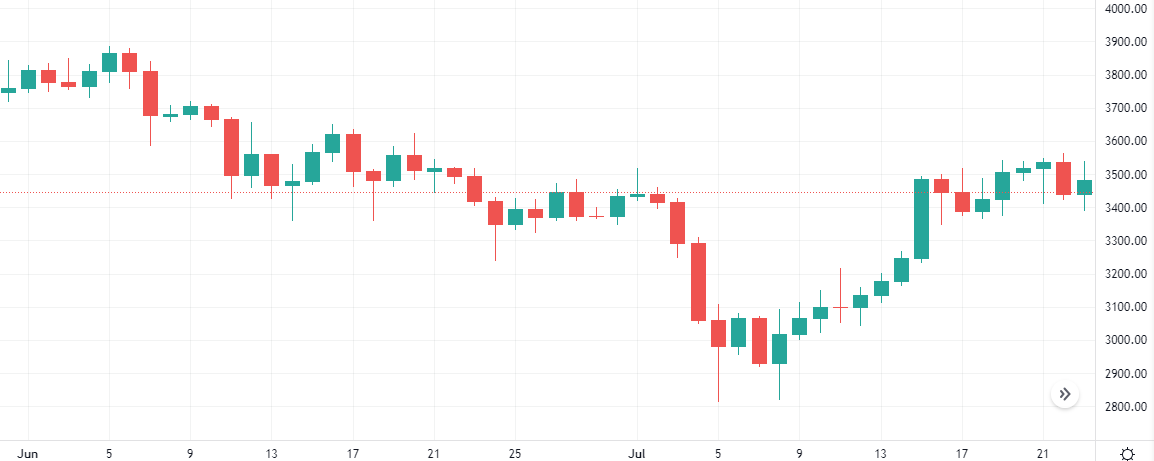

Bitcoin’s recent price rebound has shifted trader sentiment to levels not seen in 16 months, according to data tracking positive and negative social media comments about Bitcoin. BTC gained 20% in the last three weeks.

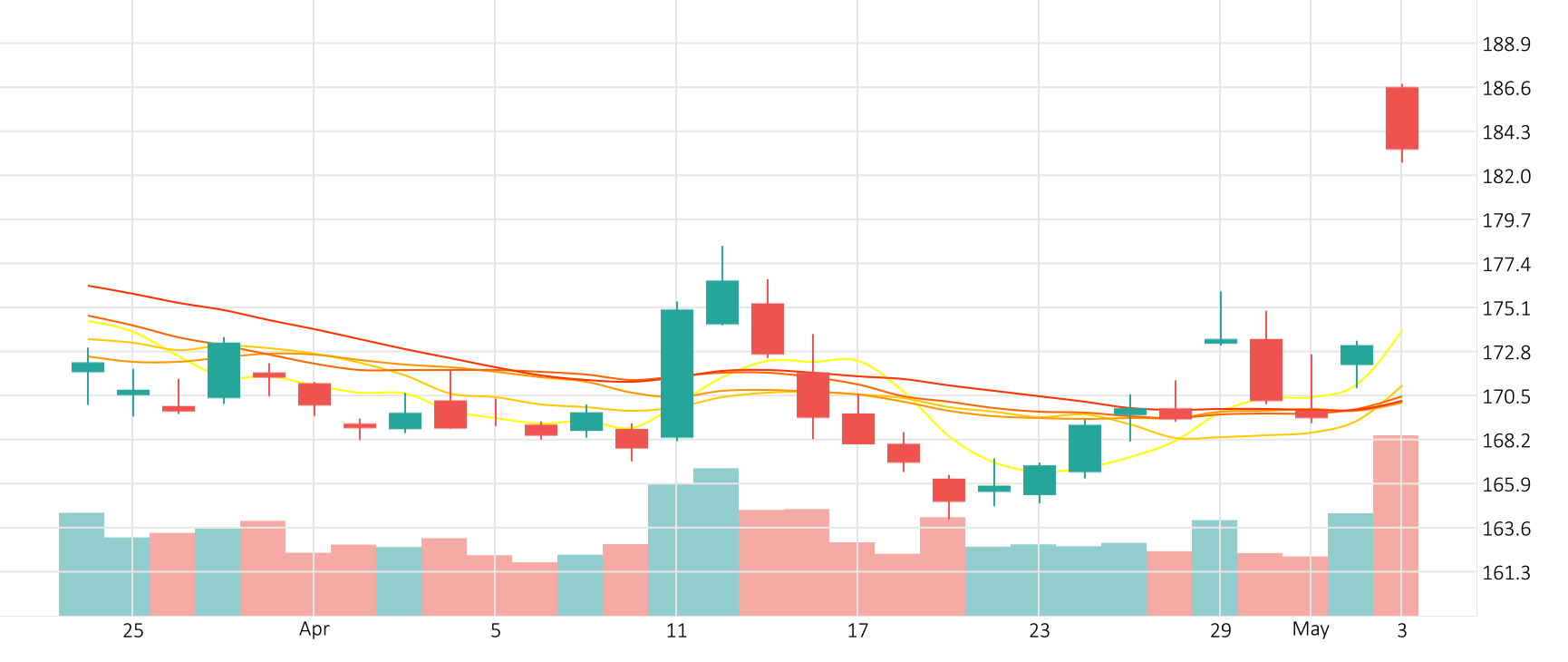

The Bitcoin-Dollar pair traded sideways in the last session. The Stochastic-RSI is giving a negative signal.

BTC/USD traded sideways in the last session.

The Stochastic-RSI is giving a negative signal.

Support: 65464.3333 | Resistance: 70806.3333