Sterling edged higher while UK stock futures fell after Prime Minister Rishi Sunak called a parliamentary election for July 4, which analysts said removed a degree of political uncertainty from the picture for traders.

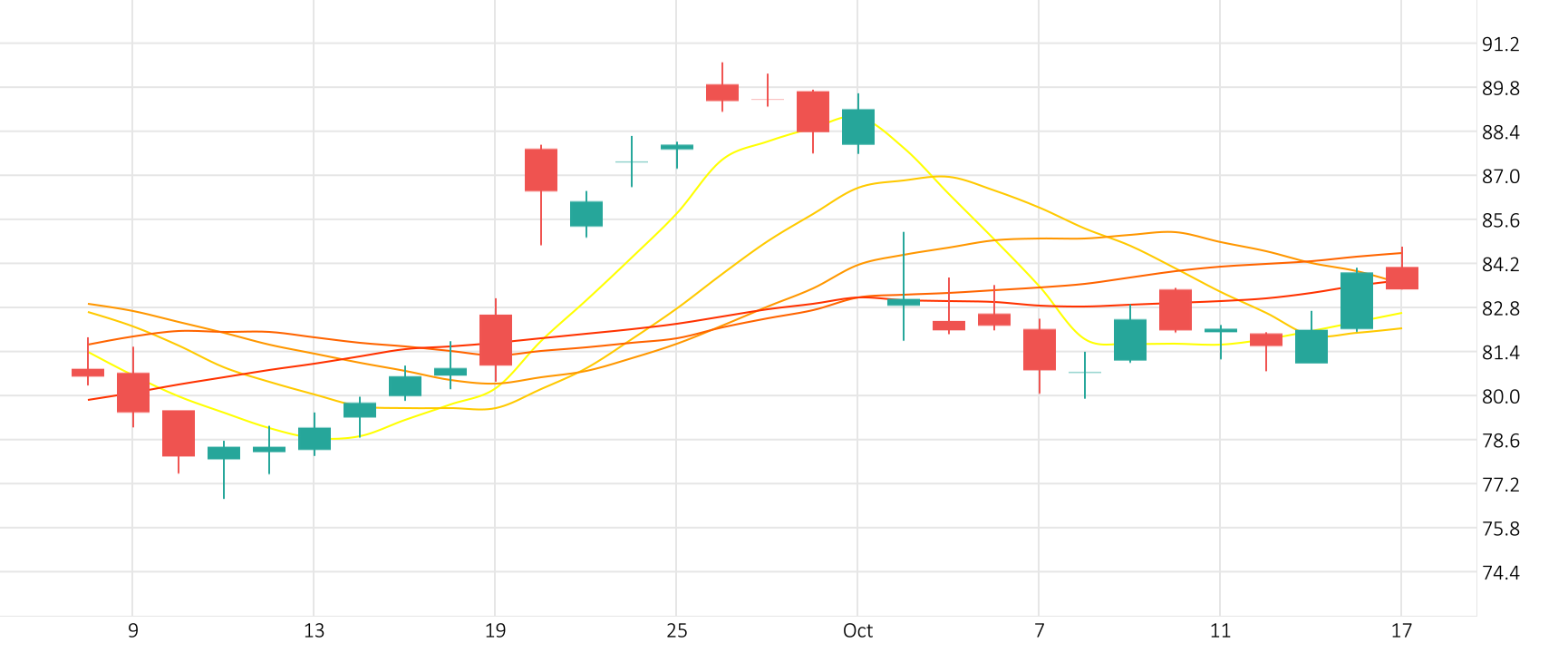

The ROC for the GBP/USD currency pair is giving a positive signal.

Support: 1.2668 | Resistance: 1.2748