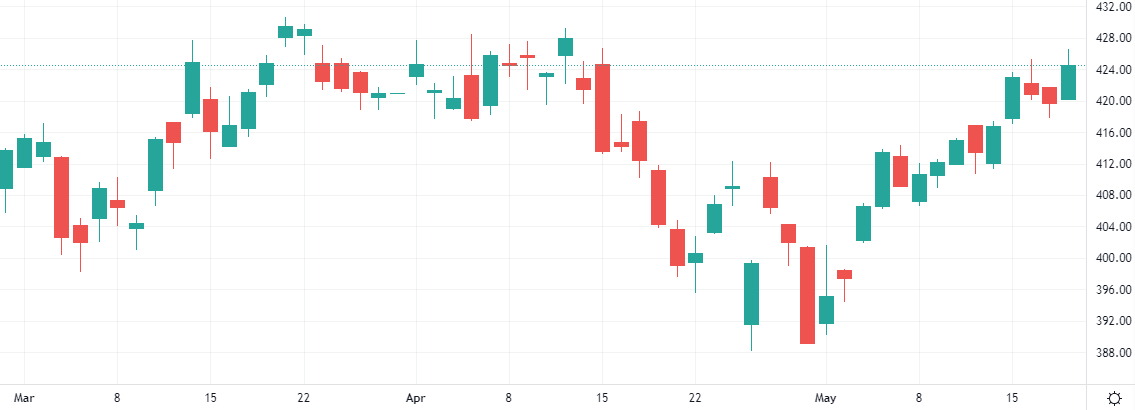

The last session saw Microsoft shares gain 1.2%. According to the Williams indicator, we are in an overbought market.

Microsoft shares gained 1.2% in the last session.

The Williams indicator points to an overbought market.

Support: 415.9473 | Resistance: 424.3763