The last session saw Microsoft’s stock rise 1.2%. The CCI indicates an overbought market.

Microsoft shares gained 1.2% in the last session.

The CCI points to an overbought market.

Support: 409.3332 | Resistance: 421.0934

The last session saw Microsoft’s stock rise 1.2%. The CCI indicates an overbought market.

Microsoft shares gained 1.2% in the last session.

The CCI points to an overbought market.

Support: 409.3332 | Resistance: 421.0934

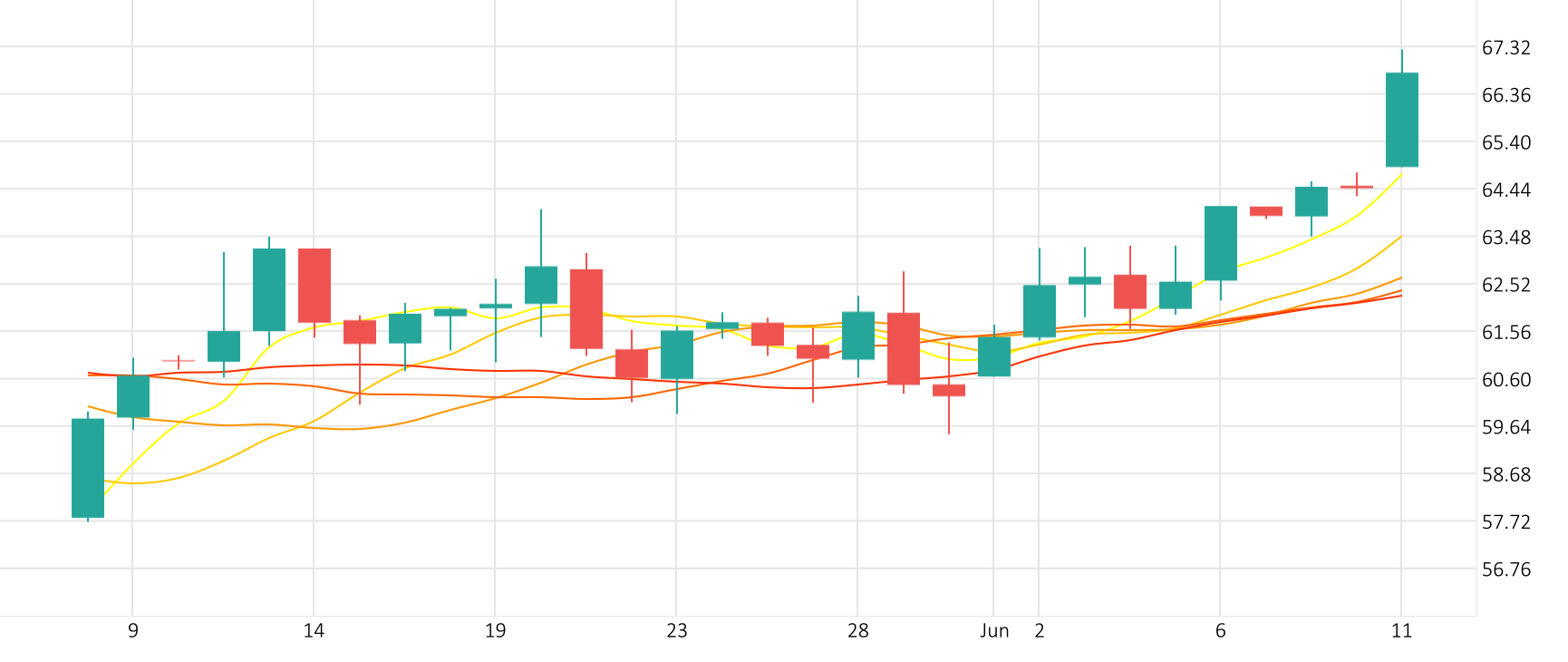

The Oil-Dollar pair rose 0.4% in the last session. The Ultimate Oscillator is giving a positive signal.

WTI/USD rose 0.4% in the last session.

The Ultimate Oscillator is currently in positive territory.

Support: 76.9467 | Resistance: 80.2667

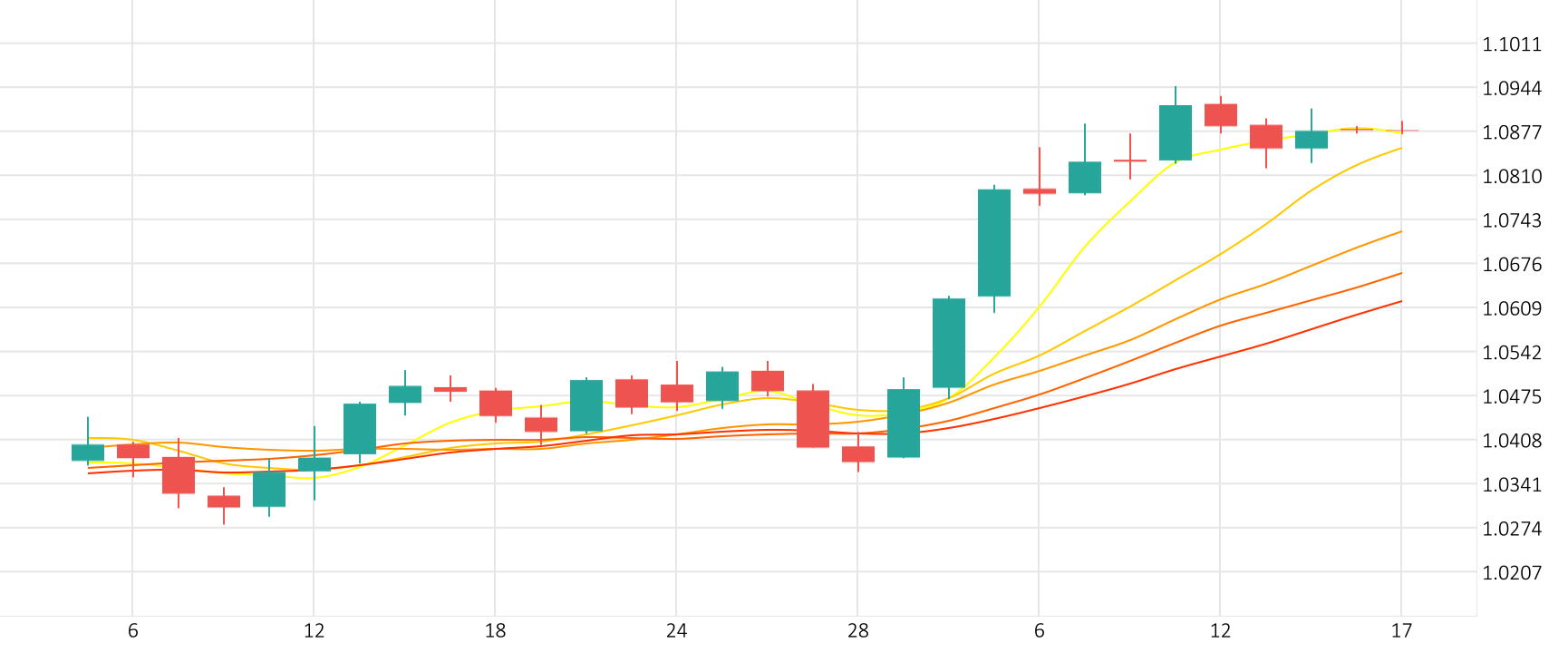

The last session saw the Euro rise 0.6% against the Dollar. The Stochastic indicator is giving a positive signal.

EUR/USD rose 0.6% in the last session.

The Stochastic indicator is currently in the positive zone.

Support: 1.0744 | Resistance: 1.0861

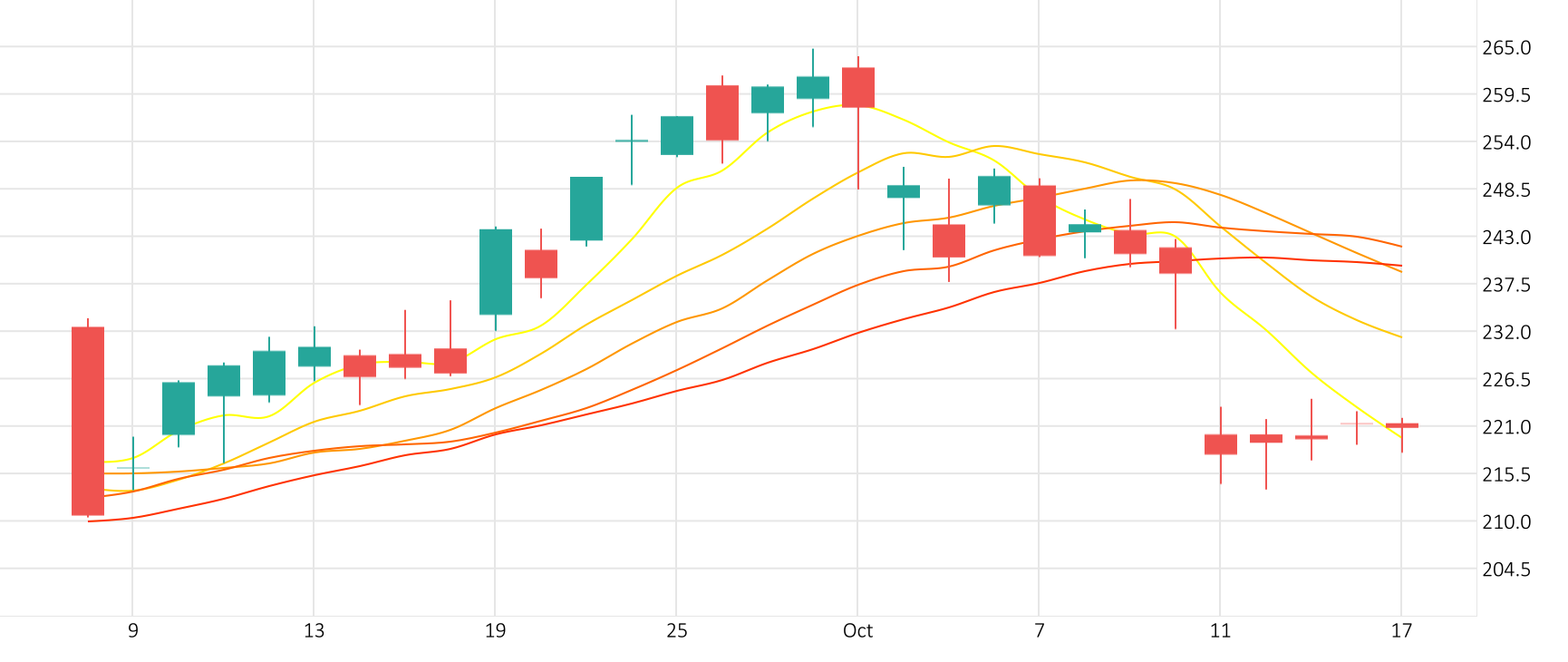

The Gold-Dollar pair gained 0.8% in the last session. The Ultimate Oscillator is giving a positive signal.

XAU/USD gained 0.8% in the last session.

The Ultimate Oscillator is currently in positive territory.

Support: 2312.951 | Resistance: 2377.311

The last session saw Tesla shares gain 1.7%. The ROC is giving a negative signal.

Tesla’s stock gained 1.7% in the last session.

The ROC is currently in negative territory.

Support: 165.8235 | Resistance: 178.4233

The Pound-Dollar pair made a minor upwards correction in the last session, gaining 0.1%. The Stochastic indicator’s is giving a negative signal.

The Pound-Dollar pair gained a moderate 0.1% in the last session.

The Stochastic indicator is giving a negative signal.

Support: 1.2494 | Resistance: 1.2602