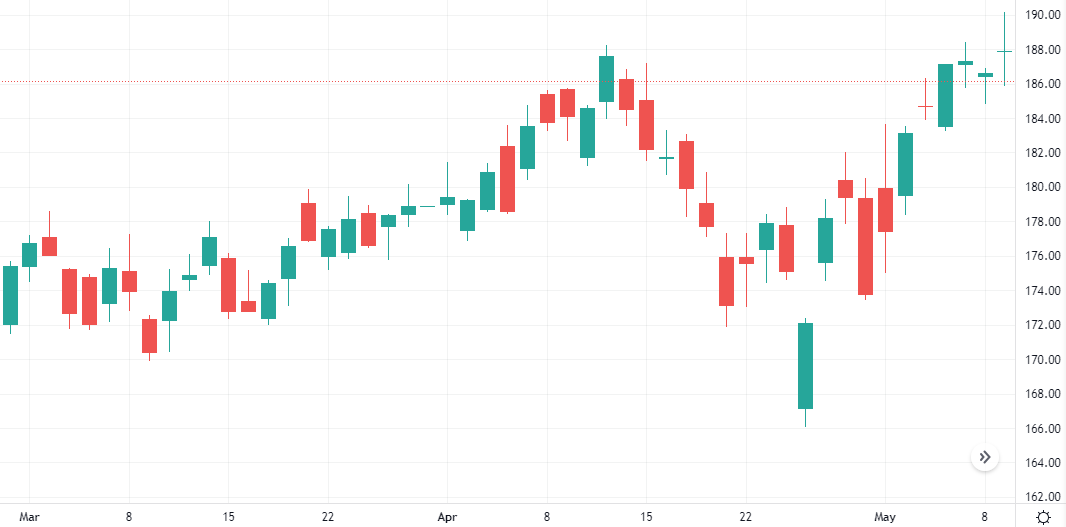

Amazon shares made a minor upwards correction in the last session, gaining 0.3%. The Stochastic indicator indicates an overbought market.

Amazon shares saw a minor rise of 0.3% in the last session.

The Stochastic indicator is signaling an overbought market.

Support: 185.5867 | Resistance: 189.6267