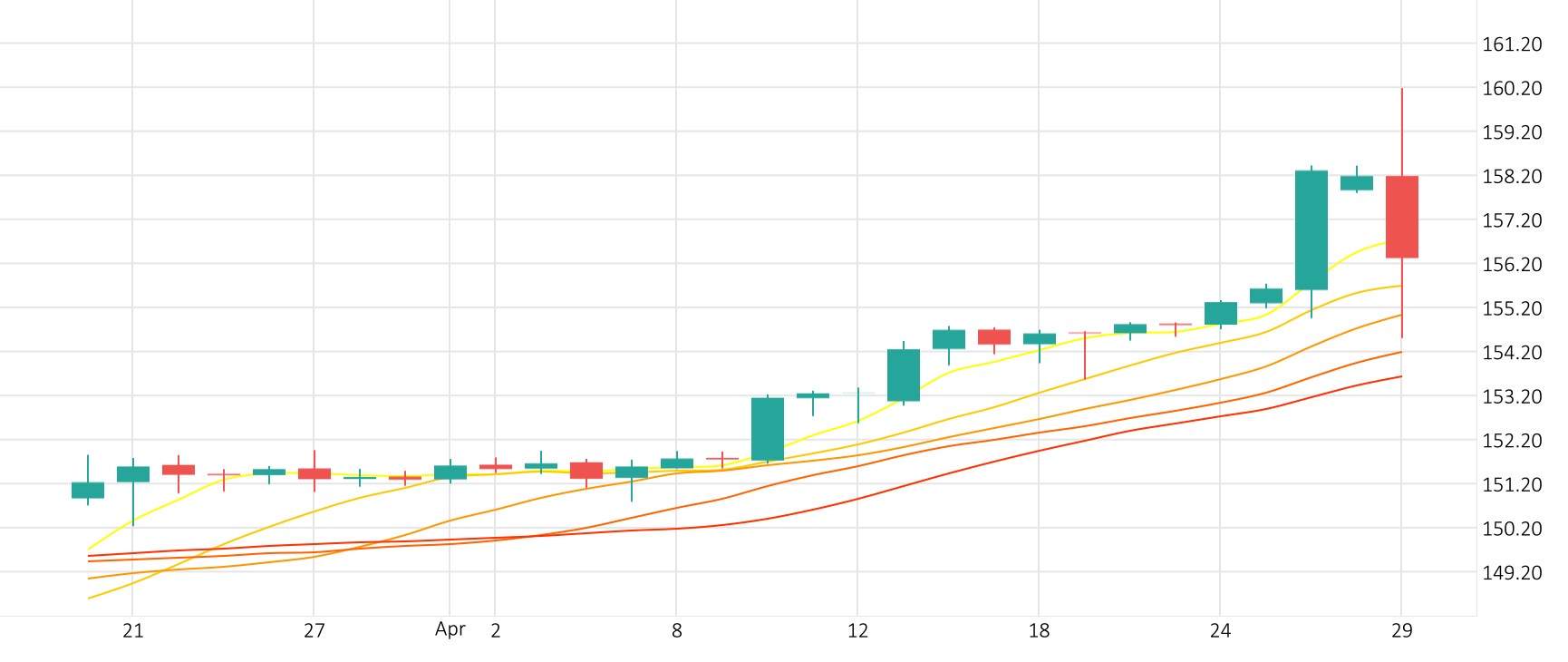

The Gold-Dollar pair skyrocketed 1.2% in the last session. The Stochastic-RSI is giving a positive signal.

XAU/USD skyrocketed 1.2% in the last session.

The Stochastic-RSI is currently in positive territory.

Support: 2250.4177 | Resistance: 2353.6237