A U.S. appeals court reinstated President Donald Trump’s sweeping tariffs, leaving Wall Street with no clear direction a day after most of the tariffs were blocked by a trade court, a move that had given markets a brief boost.

A U.S. appeals court reinstated President Donald Trump’s sweeping tariffs, leaving Wall Street with no clear direction a day after most of the tariffs were blocked by a trade court, a move that had given markets a brief boost.

US crypto mining stocks tumbled after minutes published by the Federal Reserve signaled its growing uncertainty about the country’s economic outlook. The crypto market remained unscathed, despite the stock drops among crypto miners.

Dell Technologies raised its annual profit forecast, signaling growing demand for its AI-powered servers that are equipped with Nvidia’s powerful chips, sending the computer hardware maker’s shares up 10% in extended trading.

GameStop, the US video game and consumer electronics retailer, has confirmed its first Bitcoin investment, acquiring 4,710 Bitcoin. The announced acquisition is GameStop’s first publicly acknowledged Bitcoin purchase since the company disclosed plans to move into Bitcoin investment in March.

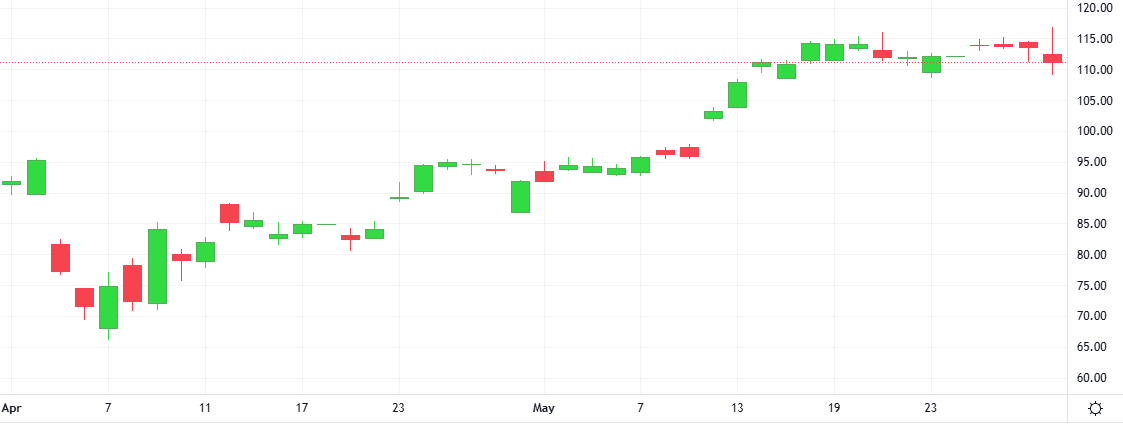

Sterling was steady against the dollar, hovering near Monday’s three-year high, as it continued to be supported by favourable economic data last week as well as Britain’s recent trade deals.

The Pound-Dollar pair fell 0.3% in the last session. The Stochastic-RSI is giving a negative signal.

Support: 1.3362 | Resistance: 1.3581

Oil prices gained on supply concerns as OPEC+ agreed to leave their output policy unchanged and as the U.S. barred Chevron from exporting Venezuelan crude. Investors previously anticipated members of OPEC+ would agree to a production increase later this week.

The Oil-Dollar pair gained 0.6% in the last session after rising as much as 1.3% during the session. The Stochastic indicator is giving a positive signal.

Support: 58.912 | Resistance: 63.862