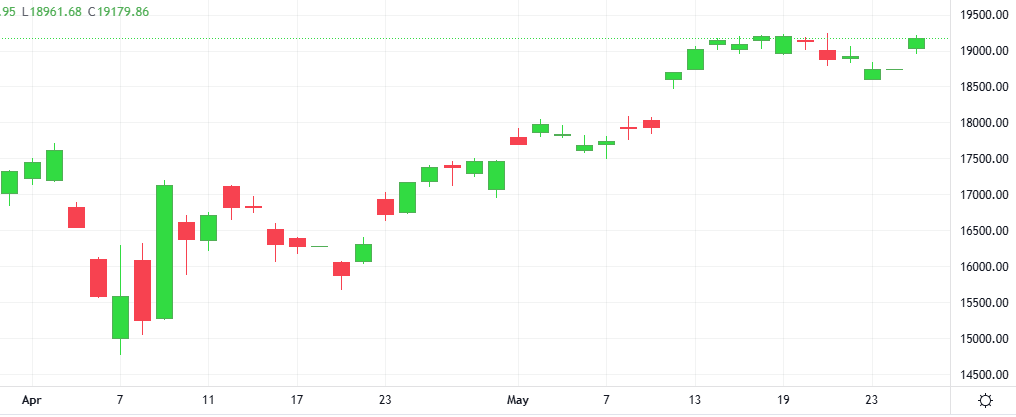

Wall Street surged as investor risk appetite was buoyed by Trump’s latest tariff respite and an unexpected jump in consumer confidence. A rally sent all three major U.S. stock indexes higher, with strength in the AI-related “magnificent seven” group of stocks putting Nasdaq out front.