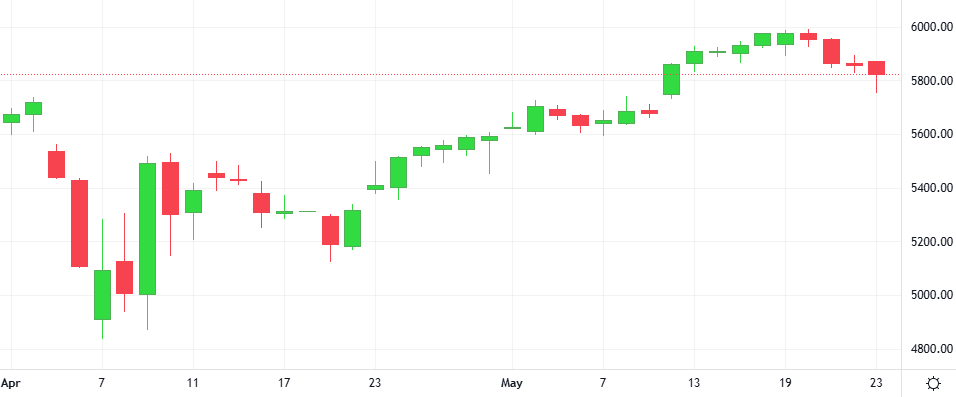

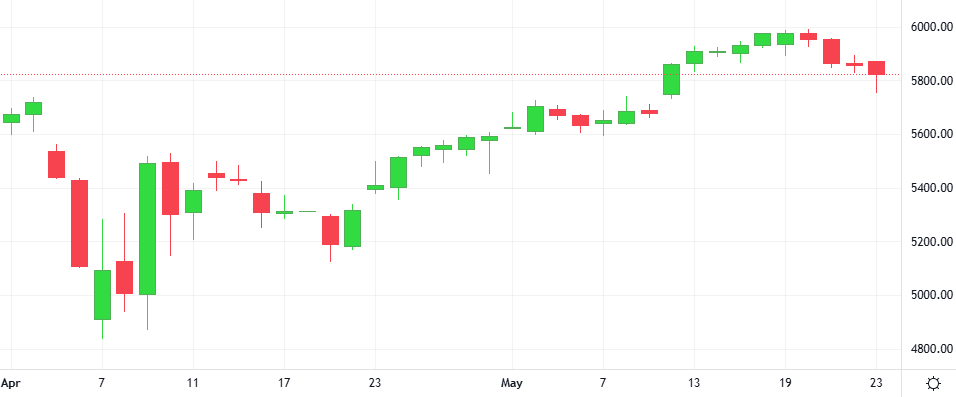

The S&P 500 struggled for direction after the U.S. House of Representatives passed President Donald Trump’s tax and spending bill, expected to burden the federal government with trillions of dollars in extra debt, by a razor-thin margin.

The S&P 500 struggled for direction after the U.S. House of Representatives passed President Donald Trump’s tax and spending bill, expected to burden the federal government with trillions of dollars in extra debt, by a razor-thin margin.

Alphabet shares jumped 4%, rising for a second straight day, as investors cheered the Google parent’s artificial intelligence updates including the rolling out of “AI Mode” to all its U.S. users.

Crypto investment products in the United States have attracted over $7.5 billion worth of investment in 2025, with a fifth week of net positive inflows last week signaling growing investor demand for digital assets.

The U.S. dollar weakened anew, weighed down in part by more cautious remarks about the economy by Federal Reserve officials, even as traders looked ahead to upcoming U.S. talks with Japan that could include discussions on currencies as part of a trade deal.

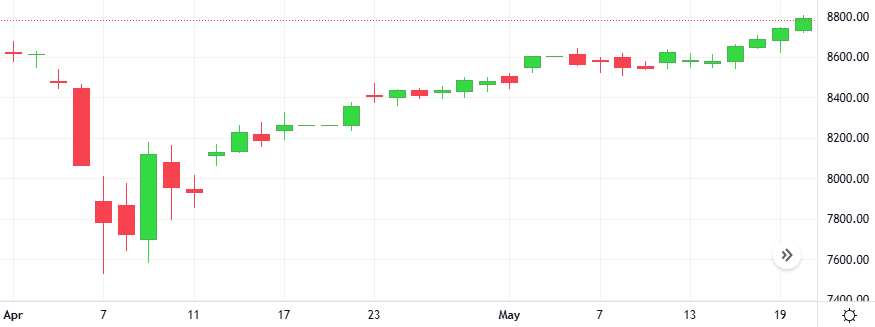

The British benchmark index FTSE 100 closed at a two-month high, buoyed by strong corporate earnings, while investors awaited updates on trade-related developments. The FTSE 100 rose over 0.9%, with a majority of the firms listed in the index trading in green.

Gold prices drifted higher, steered by a softer dollar and safe-haven demand after Moody’s downgraded the U.S. government’s credit rating. U.S. gold futures settled 1.5% higher.

The Gold-Dollar price remained largely unchanged in the last session. The Stochastic indicator is giving a positive signal.

Support: 3166.7 | Resistance: 3296