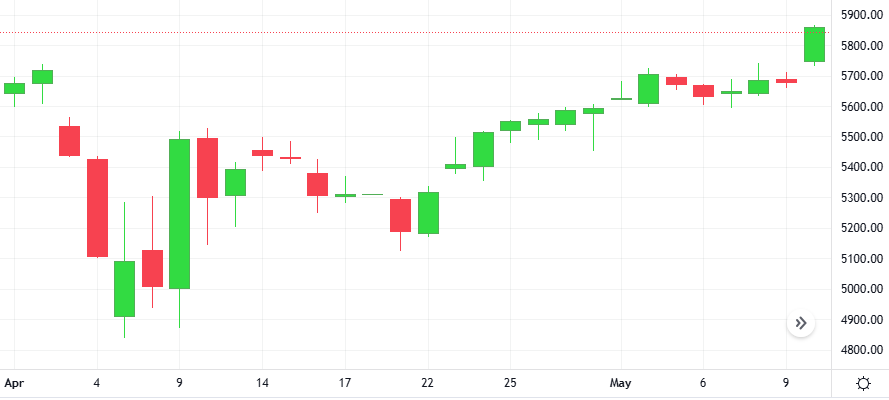

The S&P 500 closed slightly higher after flitting between gains and losses during the session as investors waited for the next batch of economic data after a robust start to the week spurred by soft inflation data and a U.S.-China tariff truce.

The S&P 500 closed slightly higher after flitting between gains and losses during the session as investors waited for the next batch of economic data after a robust start to the week spurred by soft inflation data and a U.S.-China tariff truce.

Gold prices dropped more than 2%, hitting an over one-month low, as rising trade optimism boosted risk appetite, leading investors to shift away from bullion. U.S. gold futures settled 1.8% lower.

U.S. President Donald Trump repeated his call for the Federal Reserve to lower interest rates, saying prices for gas, groceries and “practically everything else” are down. “The FED must lower the rate, like Europe and China have done,” Trump said.

Crude oil futures climbed, lifted by a temporary cut in U.S.-China tariffs and a better-than-expected inflation report. The two benchmarks rose strongly in the previous session after the U.S. and China agreed on sharp reductions to their import tariffs for at least 90 days.

The last session saw the Oil rise 0.9% against the Dollar. The CCI is giving a positive signal.

Support: 57.846 | Resistance: 65.466

Bitcoin has seen its largest 30-day illiquid supply increase of the current bull market. Illiquid supply now stands at 14 million BTC, more than ever before. Whales are still accumulating as the price returns to six figures.

After a 1.1% dip during the last session, the Bitcoin-Dollar pair closed 2.0% in the red. The CCI is giving a positive signal.

Support: 95222 | Resistance: 109592

Wall Street’s three major indexes rose sharply with the S&P 500 marking its highest level since early March as a U.S.-China agreement to temporarily slash tariffs brought some hopes for the easing of a global trade war, which U.S. President Donald Trump ignited in early April.