Online currency trading seems appealing to many young people. As it is promising. Few however can embrace market risk and really make a lot of money from it.

Online Currency Trading for Daredevils

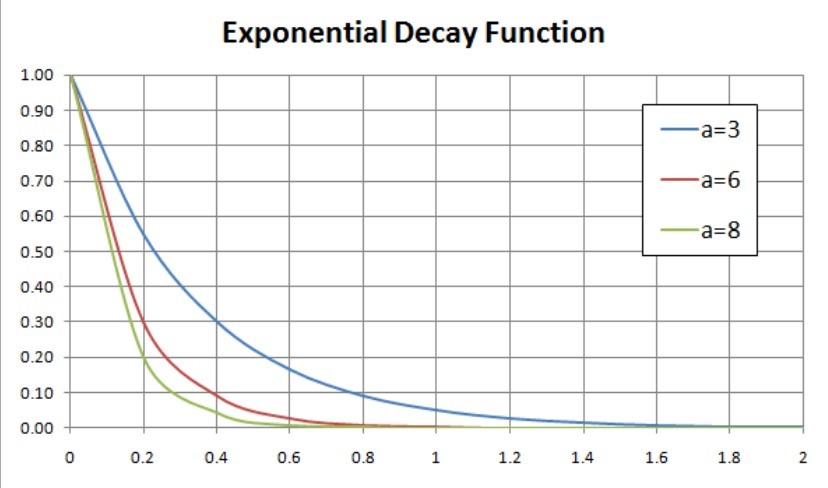

Online Currency trading is seen by big risk takers as the best way to make a lot of money fast. And in some cases they are proven very right. Because as they say, who dare wins. This is indeed true. And traders who prepare before starting trading do have the odds on their side. The idea of trading online made easy is not true, not by any stretch of the imagination. Daredevils take risks, but they do prepare before doing so. So just because someone takes a lot of risk, it doesn’t mean that this risk has not been assessed. Foreign exchange currency trading online for beginners tends to teach that excessive risk is unacceptable, and that all trading should adhere to limiting rules. Such as using a low risk-reward ratio, which is really nonsense. Risk is better understood through probability analysis, and over the weekly time frame. All other kinds of analyses which are based on single trades, are total nonsense. Risk takers have figured this out already. They know that beginner trading advice is against taking risks. They also know that no beginner trader ever made 1000% in a year. So the prospects of making good money through such basic training are non existent.

Online Currency Trading for Slow Traders

Slow traders willing to profit from online currency trading are simply low frequency traders, not beginners. They simply make fewer traders, they want to encounter less volatility, but are willing to trade at much larger size. They have an investor’s mindset, who wants to trade forex online, at significant size. And doing it slowly is just their preferred style. Slow traders can include all kinds of seasoned traders, even very sophisticated commodity CFD traders. Trading slowly and through a large account, implies that all volatility from Monday through to Friday can be handled smoothly. Plus, they have the time to plan smaller hedging trades when things go wrong. So they are in fact risk takers just like all daredevils in trading. Except that they can do a whole day away from the markets, without checking pricing, trusting their open trades to their risk management skills. Large stops and sufficient account margins make this possible. And think about it, how would a classic investor, or a classic antiques dealer trade forex? They have learned to invest big money, and to trade slowly. Waiting one or 3 weeks for a good forex trade is okay with them. The average trade in the antiques market may takes several years. So patience is second nature to them. They are also selective. Seeing all these foreign exchange currency symbols. Slow traders are very selective as to what they will trade.

What are Your Financial Goals?

In order to achieve your financial goals you must realize that life itself is just as volatile as markets are. And tight, well defined goals are hard to reach. Whereas loosely defined goals are possible to reach, all through life’s volatility. People who make too many detailed plans, end up achieving almost nothing in life. Because life’s volatility messes everything up. So it’s best to have loose plans and an open mind, where one has to turn problems into opportunities. Forex trading is one of those things which can provide total financial independence in as early as 3 years. You can be a profitable trader within 3 years. But realistically, it’s not possible to cut the learning curve any shorter. Because 3 years is enough to expose you to extensive market volatility and confusion. Turning you into a superstar trader.