Currency Trading Online Companies and Banks Do

By Content-mgr - on April 5, 2016The currency trading online companies and banks do has to do with hedging risk and speculation. Import- export companies mainly hedge risk, while banks do both.

Currency Trading Online Companies, Banks and Hedge Funds Do

The kind of currency trading online companies, banks and hedge funds do, is sometimes very similar. Other times it can be completely different. An export company in Japan for example, is mainly concerned with exchange rates between the Yen and the Euro, and between the Yen and the US dollar. If too much is exported to the US, a falling US dollar will hurt their profits. But also an excessively rising Yen, may be bad as well. Companies hedge against unforeseen and sharp market movements, through a series of sophisticated trades. Hedge funds and banks trade for speculation so as to profit from the markets directly, but some of their trades are similar to those performed by corporations. Then there are manufacturers, who have their own investment banks. And these Company-owned investment banks do both protective hedging and speculative trading. So in reality there is no big difference between large sophisticated companies and banks. They all take risks in the market, and they all provide liquidity to other traders. Profitable trading in foreign currency is always the goal. Some investment banks can also be involved in providing consumer level financial products, such as mortgages to clients in a foreign country. Or even buy mortgages that are under water, from the original issuing banks. So in effect, they can also be related to consumers just like car makers and airlines are. The currency trading online companies and firms do may also involve day trading forex methods, and other complicated trading methods.

How Can You See the Currency Trading Online Companies and Banks Do?

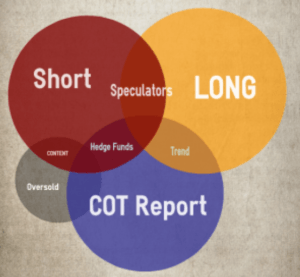

Is there a way for you to see the currency trading online companies and banks do? Well, not really! It is possible to figure out some of the strategies of these firms, and how they are likely to trade. That is based on the risk that export companies will face as currency rates change dramatically. This is fairly easy to figure out. But these firms and banks themselves can get it wrong, and be on the wrong side of the market. Moreover, their trades are revealed through the COT report, but they are meaningless. The fact that commercial traders (as they are known), are long a certain currency, doesn’t mean anything. It doesn’t mean that that currency will rise, nor that they expect it to rise. It may simply mean that they are long another currency, which is inversely correlated. This trade may be an actual forex trade, or the exposure to the global forex market through their import / export activities if they are a company. That fundamental trade is not seen in the COT report — only the hedging trade is seen. Therefore the COT report is totally misleading, about half the time, and therefore useless to retail traders. Some traders believe that only in stocks, one should watch out institutional trading activity. Single stocks, which are well selected, are worth investigating further. Stock traders tend to monitor successful investment banks, and what stocks they invest in. Then trade the same stocks, through CFD contracts and the best forex trading platform they can get their hands on. This does work with certain investment banks, but that’s about following institutional trading. When it comes to forex and commodities, companies and banks take the same risk as you do. Following them is not a good idea because they can be wrong on the trade.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification