Trading CFD strategies and ideas allow for above average results and for better risk control are perfectly possible to implement. And wise traders know how.

Trading CFD Strategies You Can Develop

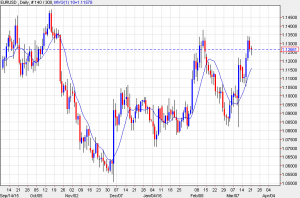

Some trading CFD strategies you can develop today. They can include trend-following and hybrid strategies between day trading, swing trading and directionless trading. The basic concept in all these ideas, is to use confusion and volatility in your favor. These are given market facts, and will never go away. So instead of planning ahead to execute a single trade from A to B, which is what conventional wisdom dictates. You should include a more complex path, from A to B, but also from A to C, in case the trade takes too long, or fails to yield a profit. They don’t teach such methods and ideas in the average forex trading course, because the mentor will probably have some kind of tight stop mentality. But tight stops never really work, and no one made good money trading like this. Good trading CFD strategies take trading beyond classic ideas, and into hybrid trading. You are neither a day trader or a swing trader, in fact no established term may define your trading. Because the currency markets trade in all kinds of patterns, where confusion and volatility rule. You can still be a specialist in your market, but there is no need to believe in specialized tradings styles. Low volatility means you will have to trade almost like a scalper. High volatility means you will have to trade differently, and often against the daily trend as well. Many established rules in classic trading will have to be broken and adjusted through modification. As a rule of thumb, you will know that the market may go from A to B as your analysis suggests, but it will do so in the most confusing way possible. This is a natural tendency of the financial markets. Good CFD strategies are very profitable, but require using large stops, and a plan B. A plan where if the first trade idea fails, the probability for plan B becoming successful trade increases dramatically.

Trading CFD Strategies and Risk Control

Beyond the classic methods for risk control, trading CFD strategies allow for affordable hedging through commodities. This is the holly grail of hedged Carry trading. But the key concepts apply to directional currency trading as well, as long as the market is a commodity currency. Anyone who knows what is CFD trading, and the benefits it offers, can figure out the role of commodities. Markets are interrelated and commodities are correlated to specific currencies. All good CFD trading platforms offer both commodity and currency trading. You will have to become a specialist in the underlying market, crude oil for example. That is the very underlying market which makes up both crude oil price and USDCAD price trends. You can control much of the risk by viewing both of these markets as one entity, and identify opportunities occurring daily, weekly, etc. One time it might be a day trade, lasting 1 hour. Another time it may be a trade lasting 10 days. You will have to use large stops, hold trades overnight, and have a plan B in case plan A fails. If a trade takes longer than usual to become profitable, then the probabilities will be against that trade. And will favor trade plan B.