A good forex trading system is one that the trader feels comfortable using. So that they are psychologically resilient. Beyond that it’s about numbers.

Public Opinion Cannot Define a Good Forex Trading System

A good forex trading system is usually developed around radical new ideas, ideas that the public will surely oppose and ridicule. Which is why developers of such systems do not reveal much of their ideas and beliefs. The forex market in particular offers a really wide range of possibilities for developing a radical trading system, more so than in stocks. A good forex trading system may for example be based around time zones and transitional hours between these times zones around the 24 hour global currency market. Even though many traders know about this, they don’t feel comfortable trading outside their own comfort time zone. Rather, the public always tries to make a 9 to 5 job out of their trading. And these are the people who use their trading activity, as an identity when their friends ask them what they do for a living. Wise traders keep quite about their trading, and they know it might take years to achieve their objectives. Even when profitable, some traders still keep quiet and use other activities to hide their trading. Public opinion is very wrong, most of the time, about everything, including the financial markets of course. Wise traders develop their trading systems quietly, without feeling obliged to present a final result to anyone, and they know they can also fail without any embarrassment. That’s why most good traders are reclusive people, working in isolation. People who really believe that trading can be far superior to any 9 to 5 job. In fact, many of them have been fired from such jobs and feel animosity towards the established job market. Because a 9 to 5 job will pay according to supply and demand rules and luck, and it also robs the employee from much creativity. Whereas the financial markets are the best employer, because only the best get paid.

A Dependable Forex Trading System

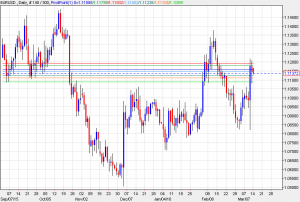

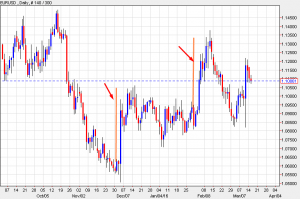

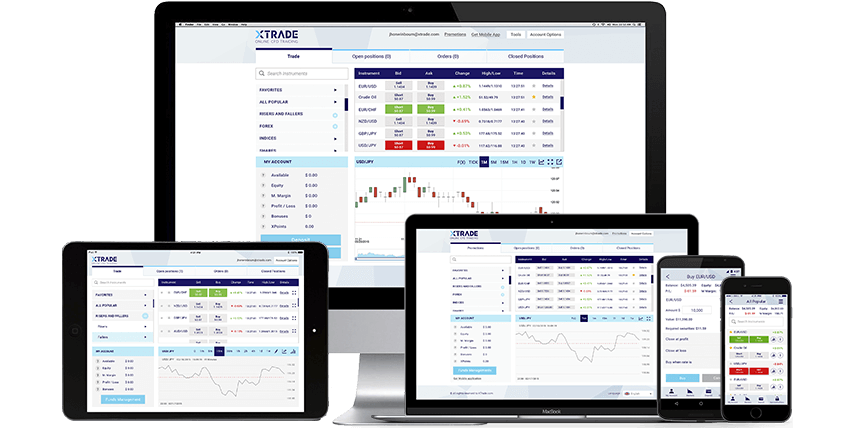

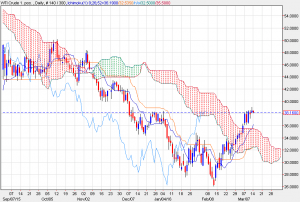

Traders need a dependable forex trading system, and one that offers account safety. So that they can lose 90% of their money at rough trading times, and still manage to recover all the way up, from that remaining 10% trading balance. That’s what a dependable trading system is. To achieve this, they also need to find the best forex trading platform around, and those wise enough actually do. In fact, many good CFD trading platforms offer so much, that any farsighted forex trader can use to propel their trading far ahead. The confidence gained through trading experience is priceless, for all truly devoted traders. It is proof that their ideas actually work, and that markets are not totally random to them. Indicators such as CCI, RSI, flags, and LSS pivots, though known to the public, allow for so much creative use. Wise traders take such classic indicators and use them in order of importance, and in very creative ways. Other traders go beyond these, and use fundamental analysis, specifically tailored to the short term trend. Fundamentals by nature are a bunch of ambiguous data, and are highly complex. But once in a while a good trade appears through those. Good traders trade with more money when the signal used is a result of fundamental analysis.