Forex calculators have been an integral element in the arsenal of forex brokers and traders since the beginning of time and while advanced versions at present can perform multiple calculations with multiple variables, the actual mathematics involved is usually straightforward algebra. In addition to forex calculators, forex brokers also use forex charts. All in an effort to understand what is forex.

Most popular forex calculators

- Profit / Loss Calculator — This forex calculator version is the basic accounting calculation. Input parameters include: the Trading Pair; the denominating account currency; whether buy (long) or sell (short); the trade opening and closing prices; and the lot sizes. Results are given in either pips or monetary values

- Lot Size Calculator — To understand the financial magnitude of a given trade, use this tool to calculate the position size in units and lots to precisely manage your risks. Correct lot sizing is key to managing your risk and to avoid excessive exposure to your account from a single trade. Input parameters include: Trading pair, stop / loss in pips, risk in percent, the account balance and the account currency

- Stop / Loss Calculator — Use this calculator to determine exactly how much you stand to profit or lose when your respective stop loss and take profit levels are reached. Simply select the currency pair you are trading, enter your account currency and your position size. Included in the parameters are: the trading pair, lot size, acceptable risk in percentage-of-principal terms, the account balance and the account currency. The resulting calculation yields the maximum stop loss, in pips.

- Margin Calculator — Margins allows you to buy securities by borrowing money. Thus, the margin calculator allows to compute the margin you need to hold open positions. The inputs consist of Trading Pair, leverage, account currency, and lot size.

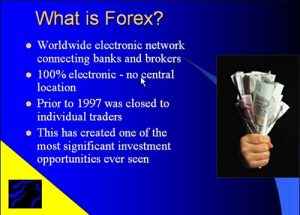

What is Forex

Forex calculators come in variations from different forex brokers. Depending on their expertise, business model and market presence, different forex brokers will bundle their trade opportunities. Usually forex calculators are offered as inducements for trading along with forex charts. Forex charts are the key analytic tool in the beginning portion of trades wherein you decide which position to initiate. Forex charts have numerous components, including:

- Time Units — Dividing your trade duration into helpful sub-units is critical in generating a meaningful chart.

- Representative Graphical Elements — Enhancing the two dimensional tracking with multidimensional representation, like with Japanese candlesticks, is also of the utmost importance

- Overlaying Indicators — Harnessing the computational power (if not the algorithmic subtlety) of cloud computing allows individual traders to pick and choose from among a plethora of offerings currently popular, like: Bollinger Bands, MACD (moving average convergence/divergence), Stochasitc Ocillator and more

- Graphical Elements — The human tendency and ability to see patterns is aided by an innate semiotic capacity. Thus basic shapes and lines as well as more nuanced Fibonacci retracement and Gann Fan patterns help make sense of analog data patterns.

In conclusion, we have looked at the topic of forex calculators from several perspectives and found it to be an integral tool, like forex charts, for thoase trying to understand what is forex.