What is Forex Trading Used For

By Content-mgr - on December 13, 2015What is forex trading mostly used for, and how can traders and investors enhance their portfolios through the currency market, and is it really so easy?

What is Forex Trading And How It is Used

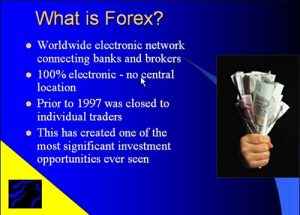

Many ask the question of what is forex trading, and how it can benefit them in their investments and businesses. Many people want to learn how to trade forex and implement this or that trading strategy to benefit from the global currency market. Forex is simply the global currency market, or otherwise known as foreign exchange market. To an investor, it is simply a mechanism for trading, through which they can buy or sell a specific exchange rate. These rates are floating freely in the market, and are depicted in forex charts. Where the forces of supply and demand determine how these rates move. Forex also helps price commodities, as many commodity prices are closely related to some local economies and their currencies. The market itself is largely decentralized through, and no central exchange exists. The Forex market has been around for decades, in the way that bankers and large corporations use it. But it was only in the late 90s that it became readily available and affordable to retail traders, and amateur traders. This has helped increase liquidity and make the market even more efficient. Which in turn helps stabilize many commodity prices and allows the consumer to get the best possible, and fairest price. This includes the goods that this consumer buys, as well as the physical foreign currency they will get wit them when visiting another country.

Where Forex is Used Most by Investors & Traders

Most traders are speculators, but many of these speculators are very serious traders who take their investment views with wisdom and determination. They make trades in order to either profit from the market, or to hedge against some market risk. All in order to protect another investment or the profitability of a physical business. This is all done through a forex broker, and these traders themselves actually make the market. This in a nutshell explains what is forex trading, and what it ‘s all about. But there is a third category of investors who pay less attention to exchange rates and more attention to interest rate differentials. These are long term investors seeking to profit from the opportunities that these differentials offer. This type of investing is known as Carry trade, and is much more difficult to do. Because exchange rate risk has to be hedged somehow, through other currencies, and there is not magic formula for doing so. Rather, the Carry trade investor works out some hedging plan, based on approximation and through making assumptions. The profitability of the Carry trade investments is made possible through the power that leverage provides.

First Deposit Bonus

First Deposit BonusFirst Deposit Bonus | Phone Verification | First Trade on us | Account Verification