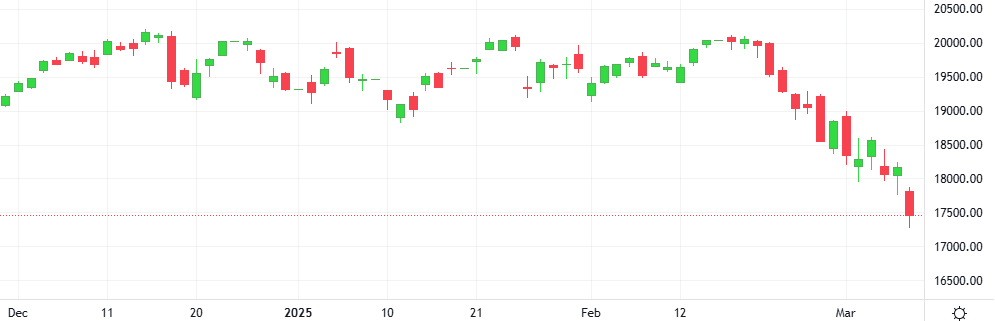

Ether is struggling to reverse a near three-month downtrend as macroeconomic concerns and continued selling pressure from US Ether exchange-traded funds weigh on investor sentiment. Ether has fallen over 53% since December, as analysts warn of lower lows amid trade war concerns and mounting ETF outflows.