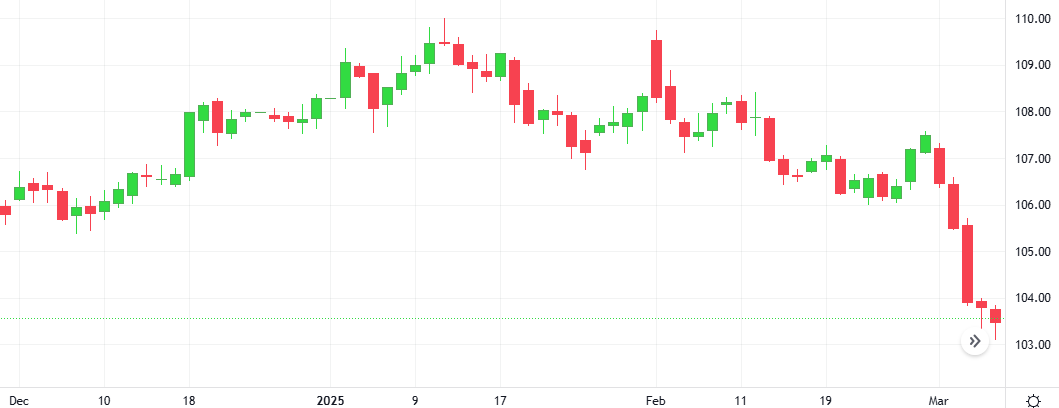

A critical inflation report in the coming week could further rattle an increasingly tumultuous U.S. stock market, with investors worried about an economic growth slowdown and President Donald Trump’s tariffs. Despite a gain on Friday, the benchmark S&P 500 marked its worst week in six months.