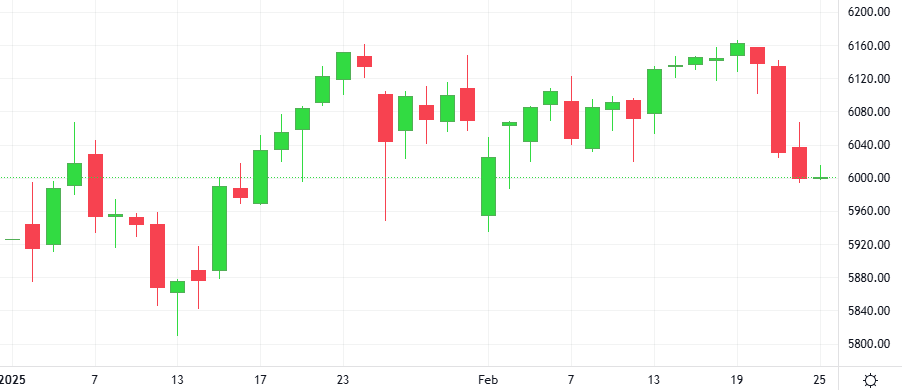

Wall Street’s main indexes were mixed in choppy trading, with technology stocks creating the biggest drag as investors awaited results from chip giant Nvidia for clues on the future of demand for artificial intelligence technology. The Dow and the S&P 500 managed small gains.