Ether reserves across centralized exchanges hit an almost nine-year low, reinforcing investor optimism for a potential market bottom that may start a recovery toward the $3,000 psychological mark.

Ether reserves across centralized exchanges hit an almost nine-year low, reinforcing investor optimism for a potential market bottom that may start a recovery toward the $3,000 psychological mark.

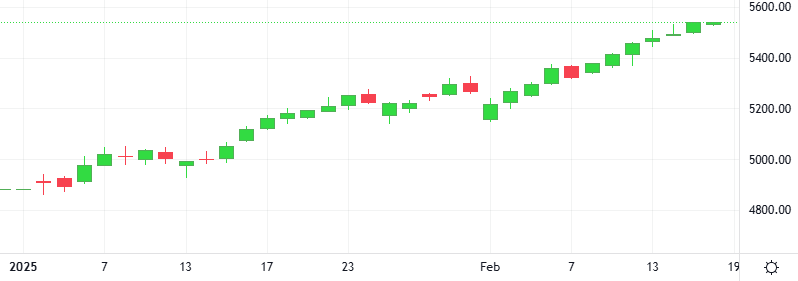

Gold prices rose over 1% as concerns over economic growth due to uncertainty surrounding U.S. President Donald Trump’s tariff plans prompted safe-haven flows into bullion. The market’s focus has now shifted to the U.S. Federal Reserve’s January meeting minutes for clues into the central bank’s interest rate trajectory.

The Gold-Dollar pair skyrocketed 1.0% in the last session. The Ultimate

Support: 2863.9 | Resistance: 2988.7

Online fast-fashion retailer Shein is under pressure to cut its valuation to about $30 billion ahead of its London listing. Its shareholders are suggesting that an adjustment is required to help get the potential initial public offering in the UK over the line.

European shares rose to record levels, led by defence stocks, as the region’s political leaders called for an emergency summit on the Ukraine war amid growing U.S. calls to boost military spending for security.

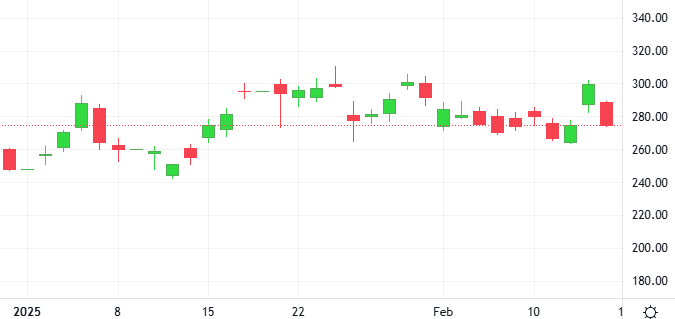

Oil prices were broadly steady as investors monitored developments over a possible Russia-Ukraine peace deal that could increase global flows by easing sanctions, while reduced Caspian supply from a pumping station drone attack curbed any selling.

The Oil-Dollar pair skyrocketed 1.3% in the last session. The RSI is giving a negative signal.

Support: 69.539 | Resistance: 72.72

The United States Securities and Exchange Commission has requested an additional 28 days to review crypto exchange Coinbase’s appeal in its ongoing lawsuit. However, the agency says its new crypto division could potentially end the 20-month legal battle.