The Canadian dollar strengthened to a two-month high against its U.S. counterpart as U.S. bond yields declined and a key level of support for the American currency gave way. The loonie touched its strongest intraday level since December 13.

The Canadian dollar strengthened to a two-month high against its U.S. counterpart as U.S. bond yields declined and a key level of support for the American currency gave way. The loonie touched its strongest intraday level since December 13.

Wall Street’s main indexes advanced after the latest producer prices data led to a lowering in inflation forecasts, while the prospect of Russia-Ukraine peace talks prompted some risk-taking among investors. U.S. producer prices increased solidly in January, offering more evidence that inflation was picking up again

Japan’s largest oil refiner, Eneos Holdings, aims to raise at least 400 billion yen ($2.61 billion) by listing its wholly owned metals unit, in what would be the nation’s biggest IPO in seven years.

Oil prices settled down more than 2% after U.S. President Donald Trump took the first big step toward diplomacy over the war in Ukraine he has promised to end, a war that has supported oil prices on concerns about global supplies.

The Oil-Dollar pair plummeted 2.3% in the last session. The RSI is giving a negative signal.

Support: 68.962 | Resistance: 74.212

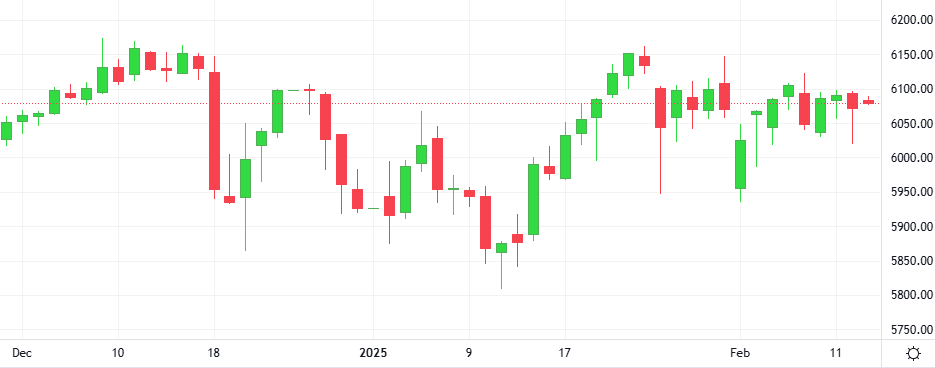

The S&P 500 dipped as a hotter-than-expected U.S. inflation reading added to worries that the Federal Reserve would not cut interest rates anytime soon, while CVS Health and Gilead Sciences rallied after upbeat quarterly reports

Circle’s USD Coin reached a $56.3 billion market capitalization, erasing the losses it sustained during the most recent bear market. The $56.3 billion market cap represents a 23.4% increase from the $45.6 billion measured on January 8th. The lowest market cap USDC reached during the bear market was $24.1 billion in November 2023.