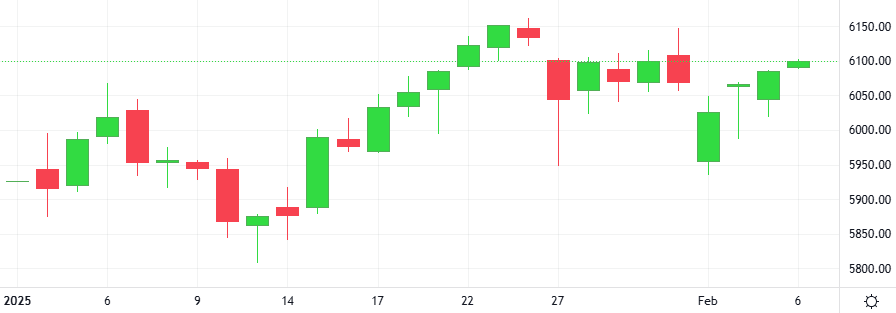

Oil prices rebounded despite lingering fears over a potential global trade war after U.S. President Donald Trump’s latest tariff plans, this time targeting steel and aluminium.

The Oil-Dollar pair exploded 1.5% in the last session. According to the Stochastic-RSI, we are in an overbought market.

Support: 69.899 | Resistance: 73.86