The U.S. dollar rose against major currencies, including the yen, euro and Swiss franc, after data showing the U.S. economy created more jobs than expected, signalling that the Federal Reserve might take longer to cut interest rates.

The U.S. dollar rose against major currencies, including the yen, euro and Swiss franc, after data showing the U.S. economy created more jobs than expected, signalling that the Federal Reserve might take longer to cut interest rates.

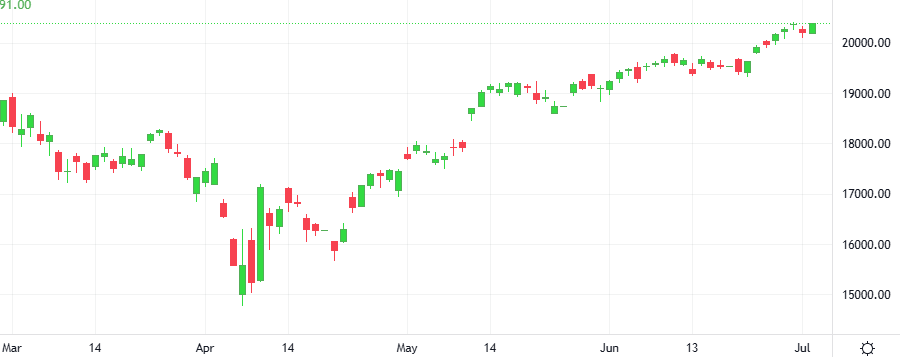

Nasdaq and The S&P 500 closed up, lifted by gains in tech stocks and news of a trade agreement between the U.S. and Vietnam that helped ease concerns about an extended trade war. Nasdaq rose, boosted by Nvidia, Apple and Tesla.

Nvidia reclaimed the top spot among the most valued companies worldwide in June, as its shares were supported by renewed optimism over its leadership in artificial intelligence and expectations of surging demand for its AI chips

Gold prices firmed as weaker-than-expected jobs data fueled hopes of the U.S. Federal Reserve cutting rates sooner than anticipated, while investors also awaited the upcoming non-farm payrolls report for further cues on monetary policy.

The U.S. dollar rose against major currencies as data supported market expectations of a Federal Reserve interest rate cut, while the pound sterling fell amid a selloff in British government bonds.

Financial market bets rose that the Federal Reserve could start interest-rate cuts as soon as this month after Fed Chair Jerome Powell, asked if July was too soon to consider rate cuts, said he “can’t say” but that the decision would depend on the economic data.

The U.S. dollar gained ground against major currencies including the euro and the Swiss franc after data showed a better-than-expected increase in labor market demand, indicating the Federal Reserve will likely take its time to cut interest rates.