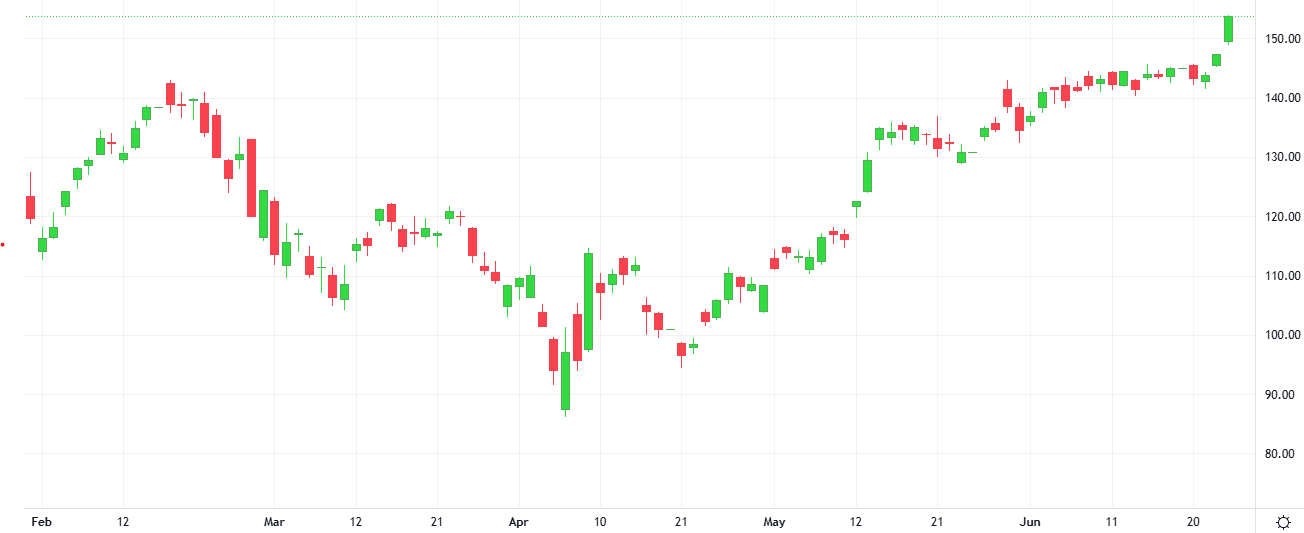

Wall Street extended its rally, sending S&P 500 and Nasdaq to all-time closing highs as trade deal hopes fueled investor risk appetite and economic data helped solidify expectations for rate cuts from the U.S. Federal Reserve.

Investors are poised to shift their attention in the coming week to key economic data and policy developments to see if the torrid rally in U.S. stocks extends higher. The benchmark S&P 500 and Nasdaq both tallied record highs on Friday for the first time in months.