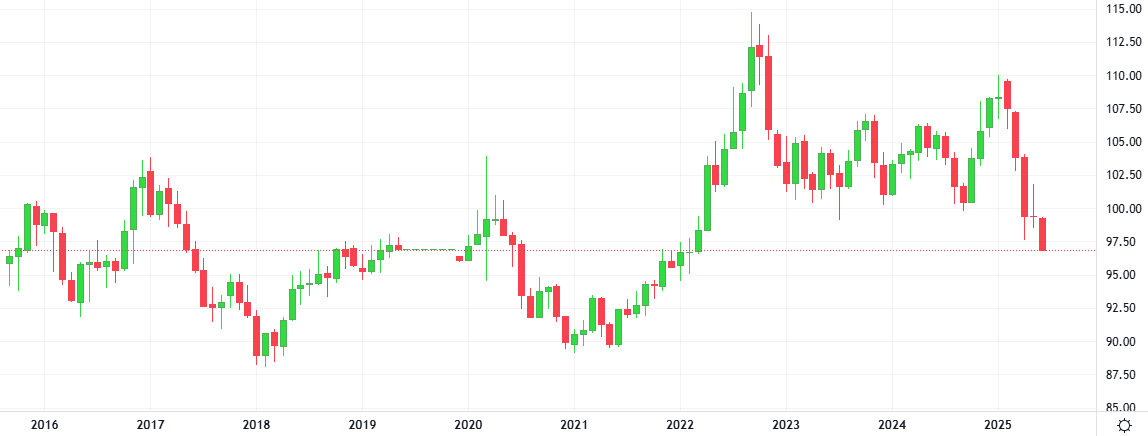

The dollar fell to multi-year lows against the euro and sterling but gained on the Japanese yen as traders evaluated expectations for Federal Reserve interest rate cuts and turned attention back to U.S. fiscal policies.

The dollar fell to multi-year lows against the euro and sterling but gained on the Japanese yen as traders evaluated expectations for Federal Reserve interest rate cuts and turned attention back to U.S. fiscal policies.

Oil prices rose, recovering from a sharp slide early this week, as data showed relatively strong U.S. demand, and as investors assessed the stability of a ceasefire between Iran and Israel.

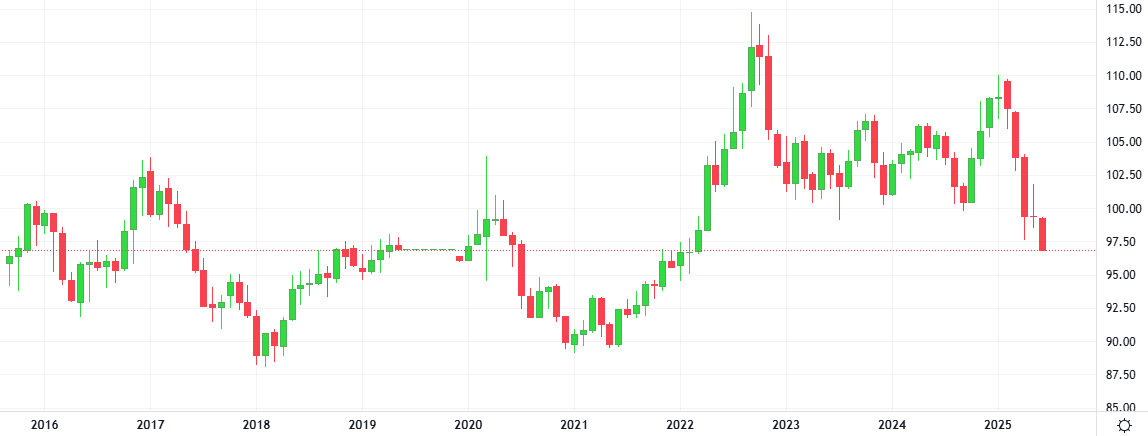

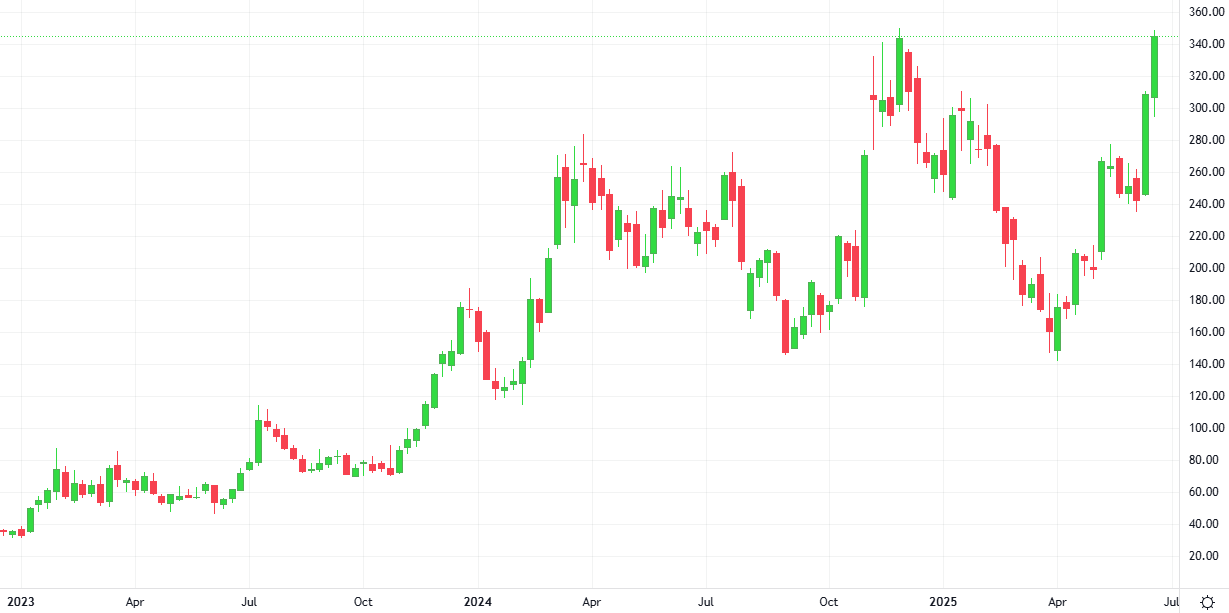

Coinbase (COIN), the largest U.S. crypto exchange, is gaining serious traction—not just from trading volume, but from a booming stablecoin business that Wall Street seems to be underpricing.

Coinbase at a Glance

Headquartered in New York, Coinbase operates a platform for crypto assets, serving both individual consumers and institutions across global markets. With a market cap of around $75 billion, it’s classified as a large-cap stock and continues to dominate the U.S. crypto exchange market, offering trading in over 50 digital assets.

Strong Momentum in 2025

Despite being 15.6% below its 52-week high of $349.75, reached on December 6, 2024, Coinbase stock has rallied significantly in recent months. Over the past three months, COIN has gained 63%, sharply outperforming the iShares Blockchain and Tech ETF (IBLC), which rose just 28.8% in the same period.

Earnings Recap

On a year-to-date (YTD) basis, Coinbase stock is up 18.9%, again outpacing IBLC’s marginal gains. The outperformance becomes even more evident on a 12-month timeline: COIN has surged 25.2%, while IBLC managed only a 2.6% increase.

On May 8, Coinbase reported its Q1 2025 earnings, which gave the stock another boost—COIN rose 5.1% following the report. The company posted $2 billion in total revenue, up 24.2% year-over-year, driven by increases in both transaction and subscription revenues, with $300M (15%) coming from USDC stablecoin income.

While revenue missed analyst expectations, earnings beat them. Adjusted EPS came in at $1.94, a 23.3% decline year-over-year, but still 4.9% above consensus estimates.

The Circle Partnership

Coinbase shares stablecoin profits through its partnership with Circle Internet Group (CRCL), the issuer of USDC. While Circle earns 100% of its revenue from USDC, Coinbase receives 50% of USDC’s total revenue.

Here’s where things get interesting:

CRCL has a current market cap of around $50 billion,

COIN, with a far more diversified and established business, sits at $87 billion.

Yet only 14–15% of Coinbase’s revenue comes from stablecoins, meaning investors may be significantly undervaluing COIN’s core exchange business compared to its stablecoin exposure alone.

What Do Analysts Say?

With a clean balance sheet ($10B cash) and bullish technical pointing to a potential breakout, some analysts expect COIN hitting $500 by 2026. Meanwhile, its stablecoin arm alone is valued less aggressively than pure-play peer CRCL, hinting at a valuation disconnect.

Among the 28 analysts covering COIN, the consensus rating remains a “Moderate Buy.” However, the average price target of $268.61 currently sits below COIN’s actual trading levels, suggesting a potential pause or reevaluation from Wall Street in the near term.

Conclusion:

Coinbase is a crypto stock with both risks and real upside. Between strong earnings, a promising stablecoin catalyst, and a healthy balance sheet, it may be more than just a trading platform—it could be a foundational player in the future of digital finance.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice.

Chainlink has partnered with payments provider Mastercard to allow the credit card company’s three billion cardholders to buy crypto onchain. Mastercard has embraced crypto in 2024 and 2025, mostly through the issuance of cards that allow users to spend cryptocurrency at merchants.

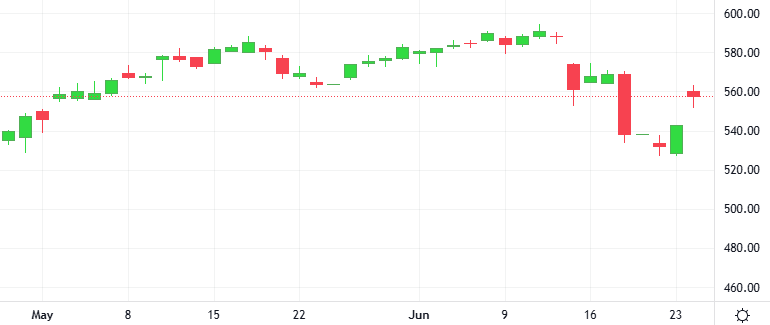

Gold fell to hit an over two-week low on Tuesday as the announcement of a ceasefire between Iran and Israel dented safe-haven demand for bullion. U.S. gold futures settled 1.8% lower.

Wall Street advanced as investors welcomed a fragile truce with Israel and Iran while parsing Federal Reserve Chair Jerome Powell’s congressional testimony for clues regarding the U.S. central bank’s path forward. Global shares were on track for a second straight day of gains with oil prices plummeting further as market sentiment was lifted by the easing of Middle East tensions, after Israel and Iran agreed to a ceasefire.